Australia's unemployment rate rose to 4 per cent in December as more people looked for work — a key metric for the Reserve Bank of Australia ahead of its first interest rates meeting next month.

Meanwhile, the local share market ended higher on Thursday, following Wall Street's lead after a series of strong bank profits in the US.

Look back at the day's financial news and insights from our specialist business reporters on our blog.

Disclaimer: this blog is not intended as investment advice.

Key Events

-

Local shares end 1.4pc higher after broad rally

-

CBA sticks with February rate cut call

-

ASX 200 upbeat after jobs data

Market snapshot

- ASX 200: +1.4% to 8,327 points (final figures below)

- Australian dollar: -0.5% to 61.99 US cents

- Wall Street: Dow Jones (+1.7%), S&P 500 (+1.8%), Nasdaq (+2.5%)

- Europe: FTSE (+1.2%), DAX (+1.5%), Stoxx 600 (+1.3%)

- Spot gold: +0.3% at $US2,726/ounce

- Brent crude: +0.2% to $US82.20/barrel

- Iron ore: +0.4% to $US100.75/tonne

- Bitcoin: –0.2% to $US99,466

Prices current around 4:20pm AEDT.

Updates on the major ASX indices:

That's all for the blog today

Thanks for spending your Thursday with us! We'll be back bright and early to do it all again tomorrow for the final time this week.

Until then, you can catch up on today's developments below.

And if you're sweltering in Brisbane like me (it's still 35 degrees as I type!), hopefully you can make like this pup ASAP.

The curious case of Star Entertainment

Hi Kate! What's the go with Star Entertainment (+7.7%)? We have stories of a mystery Asian buyer vs stories of near-bankruptcy! Someone is reading the tea-leaves wrongly!

– Andrew

Your guess is as good as mine I'm afraid, Andrew — and it's not from a lack of digging on my end, trust me!

Star Entertainment's shares picked up 3.8% on the ASX today at the close (in dollar terms, that's $0.005) to close at $0.135.

It may well be people picking up shares while they're cheap and hoping the company won't collapse, or it could be another secret investor buying them. It could even be both, or neither, or something else entirely … if I find my crystal ball, I'll report back!

(And if you are an investor with Star, have been picking up shares or selling them off, drop my colleague Emilia Terzon a line at [email protected].)

Local shares end 1.4pc higher after broad rally

The ASX 200 has ended the day 1.4% higher, closing at 8,327 points on Thursday.

All sectors finished in positive territory, with the largest gains recorded by banks (+2.5%) and real estate stocks (+2.4%).

The rise on the local share market followed a strong performance on Wall Street overnight, after a number of banks reported their financial results and US inflation cooled more than expected in December — keeping hopes alive for another rate cut by the US Federal Reserve.

As for the best performing individual stocks today:

- Neuren Pharmaceuticals +11.5%

- Zip +10%

- Corporate Travel Management +6.8%

- Karoon Energy +6%

- Tabcorp +5.9%

As for those at the other end of the scale:

- Mineral Resources -2%

- Sims -2%

- Domino's Pizza -2%

- Monadelphous -1.7%

- Ramsay Healthcare -1.3%

High Commissioner to PNG seemingly critiques Asian Development Bank

Australia's High Commissioner to Papua New Guinea appears to have taken a coded swipe at the Asian Development Bank (ADB) for awarding development contracts to foreign state-owned companies.

"We are concerned where people don't use local companies, where they are available, and don't use local labour," High Commissioner John Feakes said.

The remarks were made during the signing of a contract to redevelop a major port in PNG with funding from the Australian Infrastructure Financing Facility for the Pacific.

Australia has committed $621.4 million in loans and grants to overhaul four large ports and one tidal basin in PNG between now and 2029.

The first cab off the rank is the Kimbe port, with Queensland company Pacific Marine Group winning a $107.7 million contract to complete the marine work.

High Commissioner Feakes said the project would create 300 local jobs during the construction phase.

He said landside works were only tendered to Papua New Guinean companies, with contracts to be awarded in coming days.

"I want to contrast this approach with some of our multilateral development partners, who rely almost exclusively on foreign state-owned firms which deliver without local labour and sometimes without local supplies," he said.

Australia will contribute $492 million to the Asian Development Bank over the next four years, but the government has raised concerns about the organisation awarding contracts to Chinese state-owned entities.

Commissioner Feakes (centre) made the comments while signing a contract to redevelop a major port in PNG. (Supplied)

Graeme Smith from the Australian National University said other development partners including the US and New Zealand shared the concerns.

"The (Chinese state-owned) companies have been involved in the past in encouraging countries for example to move away from Taiwan and towards China," he said.

"As for the ports themselves, the geopolitical aspect of it would be that if you build the port, you have a great deal of knowledge about the port, but it's not as though you kind of have the launch codes."

Professor Smith said some Chinese companies had adapted to the Pacific environment and employed locals, while others tended not to.

"It really depends on the company. There's been no shortage of dud projects done by Australian companies in the Pacific," he said.

Pacific Marine Group CEO Terry Dodd said his company had experience working in PNG over three decades.

"When we come to PNG is to try to use as many local contractors as we can, we use as many local staff as we can, we spend a lot of time upskilling, training people," he said.

ADB has been contacted for comment.

Do you have shares in Star? Send our reporter an email

Emilia jumping in for a second here.

I've been reporting on Star Entertainment's woes this week as the casino operator's share price sits at near record lows and speculation continues that it is going belly up.

The ABC would like to speak to people who have shares in Star or have sold them off in recent times as they've tanked.

Is this you? Send me a confidential email on [email protected] and we can talk (even off record!)

Understanding the TikTok ban in the US

It's crunch time over in the US, with TikTok set to be banned in the country this weekend.

But there's still a few moving parts: TikTok's China-based parent company, ByteDance, could still sell its US operations — not to mention that the US Supreme Court could still step in.

For now, the ban is set to come into effect on Sunday, January 19 — the day before Donald Trump is inaugurated, and has reportedly vowed to "save TikTok".

So what does the ban mean, and what could the fallout look like? ABC Entertainment's Rachel Rasker has unpacked it for us 👇

How does the ABS know if you're looking for a job?

Hi all I’m wondering how the ABS knows if someone is looking for work? I’m retired but if I decided to look for a job how would they know that?

– Phillip

Hi Phillip,

It's a fair question, and you've come to the right place to ask it.

(And spoiler alert, no, the ABS isn't somehow secretly monitoring you!)

I'll keep it brief, but the short(ish) answer is that the ABS uses a survey of the Australian population to collect the data that forms its labour force statistics.

Not every Australian aged 15 and over is surveyed though — the ABS has a very particular methodology when it comes to how they find people to survey, where they live, how old they are, the series of questions it asks them, and how it takes those responses and broadens it out to form the bigger picture.

That is a *very* simplistic take, but there's a lot that goes into it to ensure it's accurate and reliable.

The ABS also includes its methodology with every release, which goes into a lot more detail about how they collect the data — and you can read the December iteration here on its website.

(And if you really want to nerd out, the ABS tracks every change made to how it collects the data over the years, on the off chance you find yourself in an economics trivia competition and need to do some light reading in preparation …)

CBA sticks with February rate cut call

While some economic commentators think the RBA will keep rates on hold next month, the Commonwealth Bank is sticking by its prediction that rates will come down.

Gareth Aird, CBA's head of Australian economics, believes that the combination of today's employment data and the decline in wages growth "supports our view that the non-accelerating inflation rate of unemployment (NAIRU) is comfortably below the RBA's implied estimate of 4.5% and is likely to be around 4.0%".

"Australia should be able to run an unemployment rate of ~4.0% and see inflation within the target band sustainably," he wrote.

"But we don't know if the RBA shares our view (or is coming around to our view)."

However, he says that the Consumer Price Index for the December quarter (coming on January 29) will be the deciding factor for the central bank.

"A low Q4 24 trimmed mean CPI outcome, as we forecast, should see the RBA start to shift its thinking on the NAIRU," Mr Aird wrote.

"We stick with our call for a 25 basis point (0.25 percentage point) rate cut at the upcoming February Board meeting.

"We believe a trimmed mean outcome of 0.5%/qtr or below in Q4 24 would be sufficient for the RBA to start normalising the cash rate."

Bank of Korea leaves interest rates on hold

Speaking of interest rates, South Korea's central bank has left its cash rate on hold at 3% at its first meeting of the year.

The decision to leave rates unchanged wasn't widely expected by economists, either — just seven out of the 34 polled by Reuters correctly predicted it. (The majority were expecting a rate cut.)

But Gareth Leather, a senior Asia economist with Capital Economics, expects that the Bank of Korea won't leave rates on hold for too long:

"There are good reasons to expect the central bank to resume its easing cycle soon amid signs the political crisis is weighing on the economy," he wrote.

"But even if the crisis is resolved soon, GDP growth is expected to struggle as a combination of weak income growth, a downturn in the property sector and tight fiscal policy weigh on demand.

"We are forecasting below-consensus GDP growth of 1.5% this year.

"Meanwhile, inflationary pressures are under control. The headline rate came in at 1.9% y/y in December, and has now been below the BoK's 2.0% target for four consecutive months."

Keeping cool and carrying on

Hey Kate 😀👋 You went missing 😭

– Natty

Long time, no speak Natty! It was less "missing" and more "end of year holiday" that was rounded out with a week of illness. (I'm all good now though, I promise!)

But to make up for my absence — and to try to distract myself from the absolutely horrendous 37 degrees in Brisbane right now — here's a gif that I think sums up where we'd all like to be.

ASX 200 upbeat after jobs data

As we head into the afternoon, the ASX 200 is keeping its morning rally alive — it's up 1.4% to 8,330 points as of 12:30pm AEDT.

It's little surprise to see all sectors in positive territory, but banks and real estate stocks are the best performers in the bunch, up 2.4% and 2.5% respectively.

As for the top five individual stocks:

- Neuren Pharmaceuticals +8.2%

- Star Entertainment +7.7%

- Corporate Travel Management +6.5%

- Zip +6.6%

- Tabcorp +5.9%

While the bottom five individual stocks are:

- Domino's Pizza -1.5%

- Monadelphous -1.3%

- Yancoal -1%

- Whitehaven Coal -1%

- Computershare -0.9%

Financial markets still betting on a February rate cut

Today's employment data has done little to sway the minds of financial market traders when it comes to the odds of a rate cut by the RBA at its February meeting.

Currently, the market is betting that there's about a 70% chance of the RBA cutting rates at its first meeting of the year.

That's just slightly lower than what yesterday's odds were — but the overall resilience suggests traders are feeling pretty comfortable about where the RBA's thinking is at.

(And if you're wondering about how the banks see it: Commonwealth Bank, ANZ and Macquarie are among those predicting a rate cut next month.)

Is this enough for the RBA to cut interest rates in February?

Paul Bloxham, chief economist at HSBC, isn't so sure.

Here's how he put it to finance presenter Samuel Yang on the ABC News Channel a short time ago:

"We think that given the labour market has got some more momentum and the unemployment rate is still very low.

"In fact, it looks as though it's come down from higher levels … it may be that the unemployment rate has peaked.

"That will be a pretty important factor for the RBA considering whether inflation will keep falling in on an underlying basis towards its target.

"We think when we get to the February meeting, that they [the RBA] are not going to be able to judge that they can necessarily cut rates.

"We are still of the view that a rate cut is more likely to come in the second quarter of this year rather than at that February meeting."

Paul Bloxham is the chief economist at HSBC. (ABC News)

Unemployment rate hits 4pc in December as more people look for work

Australia's unemployment has risen to 4% in December, but only because more people are looking for work.

The Australian Bureau of Statistics estimates that 56,000 jobs were added in December, but an increase in labour force participation meant the number of unemployed people also increased by 10,000.

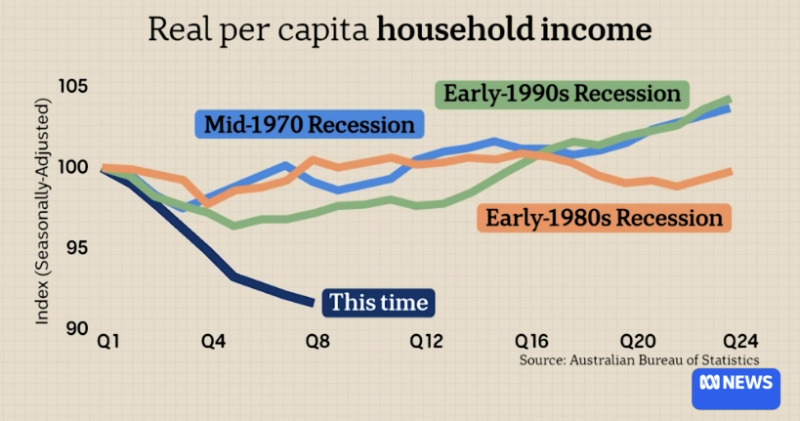

Real per capita household income lower than past three recessions

Hi there, do you have the data release used by Alan Kohler last night where he compared the real per capita household income between now and previous recessions? Thanks!

– Charles

Hi Charles,

You're in luck! I've sourced the very graph you speak of.

In case you missed it though, Alan Kohler included this graph, which showed that current per capita (or per person) household income is substantially lower, compared to what it was during our past three recessions.

Here's how he described it:

"This isn't even a recession — it's the recession you have when you're not having a recession."

Compared to the past three recessions, current real household income levels have collapsed. (ABC News)

As for the data set itself — that's available from the ABS, and just requires a bit of Excel handiwork to replicate. Plug in "real per capita household income" into Google and you should be golden.

If you wanted to catch the full spiel from Mr Kohler himself, you can watch back last night's finance report below:

Tariff war heats up

Reuters is reporting Canada could impose its own tariffs on US imports as a countermeasure to the levy Trump has announced he wants to impose on Canadian imports.

Canada will impose tariffs on up to C$150 billion worth of US imports if Trump goes ahead with his tariffs on Canadian goods and services, sources told the news wire.

Canada's minister of energy and natural resources has already announced the country would impose "tit-for-tat" tariffs on steel and orange juice if Trump followed through with his proposed plan of 25% tariffs on all Canadian imports.

ASX opens higher

As expected the ASX 200 has opened higher this morning, up +1.4% to 8,329 points.

Zip Co is one of the top movers at the open, surging +5.3% to $2.96.

Life360 Inc and Genesis Minsterals are also both up more than +5%.

Meanwhile, Computershare Ltd is leading the bottom movers down -2.8% to $33.01, followed by Monadelphous Group and Qantas.

The Aussie dollar is buying 62.28 US cents, gold is flat at $2,696.04 and Bitcoin is up to US$99,765.68

Iron ore shipments slide

Rio Tinto has reported a -1% drop in its fourth-quarter iron ore shipments, as the mining company faced operational challenges at two mines in the Pilbara.

Output declined partly due to unusually heavy rainfall, the company said, as it struggles to bring on fresh production at its Western Range Yandicoogina sites amid declining ore grades.

Steel consumption in China, its primary market, has eased due to a slowdown in the country's property sector.

Rio shipped 85.7 million metric tonnes of iron ore from the Pilbara in the three months to December 31, down from 86.3Mt in the same period last year.

That was lower than an estimate of 87.5Mt by financial analyst firm Visible Alpha.

Westpac report on market movements

Economist Jameson Coombs from Westpac has released a note on the latest movements in the market.

Lower-than-expected inflation in the US and UK brought relief to markets overnight, with stocks and bond rates rising as investors grew hopeful that interest rate cuts could be on the way.

"There is now around 40 basis points of rate cuts priced into the US rates curve for 2025 compared to around 30 basis points on Tuesday's close. In the UK there's now 55 basis points of cuts priced in for 2025, up over 25 basis points on Tuesday's close.

"The US dollar pulled back on the lower rates structure and is now back trading around pre-payrolls levels. The Japanese Yen and the Aussie dollar were the biggest beneficiaries of the weaker US dollar."

Stock markets rallied on the back of lower global interest rates, helped by positive inflation data.

The S&P 500 had its best day since November, recovering from last week’s dip after the US jobs report and turning losses for the year into gains.

In Europe, markets hit new highs for the year, though the UK’s FTSE 100 lagged behind, gaining +1.2% but not fully recovering from last week’s drop.

Asian markets were weaker yesterday, with Australia's ASX 200 down -0.2%, and stocks in Japan and China also slightly lower. However, ASX Futures are up +1.3%, suggesting a strong start to trading today.

"Rates markets finally caught a break on softer inflation data with yield structures 10-15 basis points lower across the US and UK. Europe caught some of the bid momentum with yields down around 5-10 basis points in most tenors.

"10-year yields led the rally, with 2-10-year curves flattening and 10-30-year curves steepening modestly in both the US and UK."