None of Australia’s big four banks are forecasting a rate cut when the RBA meets this week. (Reuters/file)

The Reserve Bank of Australia’s (RBA) board is meeting for the final time this year to make a decision about the cash rate.

But the decision is not expected to result in lower interest rates for people with mortgages.

And, depending on who you listen you, those holding out for a rate cut may now be waiting a few more months.

Here’s what you need to know before this week’s decision is handed down.

What is the cash rate target?

Currently, the cash rate target is 4.35 per cent.

The cash rate target is a figure set by the RBA which influences how much commercial banks charge customers for borrowing money.

But when the RBA changes the cash rate target, interest rates for mortgages don’t automatically change — the individual banks decide that.

Banks usually put out a statement saying whether they will change their rates after an RBA meeting.

Ways to cut the cost of living:

- Seasonal food swaps help save money on groceries and boost health

- These shoppers are joining forces to buy in bulk — and say they’re cutting their bills by up to a third

- How to store fruit, veggies and other groceries to keep them fresher for longer

When is the next RBA meeting?

The two-day meeting starts on Monday, but we won’t hear about rates until Tuesday afternoon.

The RBA will announce its decision on cash rates after the meeting, publishing a media statement at 2:30pm AEDT.

When will interest rates go down?

No-one knows that for sure.

So we have to rely on educated guesses from economists and banking industrial professionals.

Here’s when the major banks think rates will go down:

- ANZ: May

- Commonwealth Bank: February

- NAB: In the June quarter

- Westpac: May

That’s a big change from our wrap before last month’s meeting.

Only the Commonwealth Bank hasn’t pushed back its forecast for cuts since last month.

ANZ and Westpac had previously forecast that rates would be cut at the RBA’s first 2025 meeting in February — but they’ve pushed that back until the third meeting.

And NAB had flagged a cut in the March quarter of 2025, pushing its prediction back to the next quarter.

People paying off a mortgage might be hoping for a rate cut, but it might not come for another few months. (ABC Radio Adelaide: Malcolm Sutton)

Why isn’t the RBA cutting rates?

Because the underlying inflation rate is still high.

You might remember the RBA wanted to get inflation down to between 2 and 3 per cent.

And you might remember that, the last time quarterly inflation figures came out, it was 2.8 per cent.

And you might be thinking that 2.8 per cent fits nicely within the range the RBA was aiming for.

However, the RBA isn’t just focusing on that one figure.

The inflation rate comes from figures published by the Australian Bureau of Statistics (ABS), as in the form of something called the Consumer Price Index (CPI).

And the ABS pointed out that the main reason the CPI dropped so much was because of a fall in petrol and electricity prices — and power prices only dropped because of state and federal government rebates.

So the thinking is that this inflation rate wasn’t an accurate representation of the longer-term inflation trend.

That’s where something called the “trimmed mean” — sometimes referred to as the underlying inflation rate — comes in.

“The Trimmed mean provides a view of underlying inflation by reducing the effect of irregular or temporary price changes that can impact the CPI,” the ABS explains.

And, in the last quarterly report, the trimmed mean was calculated by essentially leaving the power price rebates out of the picture.

That put the underlying inflation rate at 3.5 per cent.

“While headline inflation has declined substantially and will remain lower for a time, underlying inflation is more indicative of inflation momentum, and it remains too high,” the RBA said after last month’s meeting.

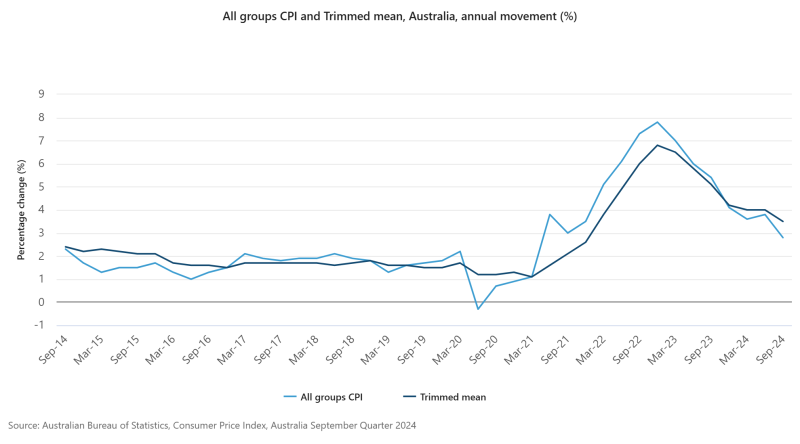

Here’s a look at the CPI compared to the trimmed mean over the past decade:

The CPI figure is the lighter line, while the trimmed mean in the darker line. (Australian Bureau of Statistics)

You can see that, while it generally follows the same trend as CPI, the trimmed mean — or underlying inflation — has less dramatic peaks and troughs.

And when you look back at the board’s past statements, it never promised to cut the cash rate as soon as CPI was under 3 per cent.

Here’s the exact wording the RBA used in its statements after the February, March, May and June meetings:

“The Board needs to be confident that inflation is moving sustainably towards the target range.”

And here’s the wording it used after August and September’s meetings:

“Policy will need to be sufficiently restrictive until the Board is confident that inflation is moving sustainably towards the target range.”

The word “sustainably” is key here because the RBA wants to see the inflation rate consistently stay within this range — not just as a one-off.

How long has the cash rate been 4.35 per cent?

A year.

The cash rate was increased to 4.35 in November last year and hasn’t changed since then.

When was the cash rate last this high?

More than a decade ago.

The last time the cash rate target was higher than 4.35 per cent was in November 2011, when it was 4.5 per cent.

When will the RBA meet again?

After this week’s meeting, the board won’t get together to make another decision about the cash rate until next year.

The first meeting will be held on February 17 and 18.

What are RBA’s 2025 meeting dates?

The RBA will meet eight times next year:

- February 17 and 18

- March 31 and April 1

- May 19 to 20

- July 7 and 8

- August 11 and 12

- September 29 and 30

- November 3 and 4

- December 8 and 9