Australian shares have fallen further, adding to Thursday's $50 billion in losses, putting the ASX on track for its worst month since 2022.

Global markets remain under pressure, despite the Dow Jones snapping its losing streak.

Follow the day's financial news and insights from our specialist business reporters on our live blog.

Disclaimer: this blog is not intended as investment advice.

Key Events

-

Shoppers will spend almost $70b in lead up to Christmas: Roy Morgan

-

The ASX is now trading at a 3-month low

-

Bill Shorten is slamming AGL over the Centrepay scandal

Market snapshot

- ASX 200 futures: -1.1% to 8,114 points

- Australian dollar: +0.4% at 62.37 US cents

- S&P 500: -0.1% to 5,867 points

- Nasdaq: -0.6% to 19,752 points

- FTSE: -1.1% to 8,105 points

- EuroStoxx: -1.5% to 506 points

- Spot gold: +0.3% to $US2,595/ounce

- Brent crude: -1% to $US72.63/barrel

- Iron ore: -1.5% to $US101.20/tonne

- Bitcoin: -3.2% to $US97,626

Prices current around 11:45am AEDT

Amazon says US worker strikes won't impact Aussie delivery

The world's biggest online retailer has been hit by worker strikes at 7 of its US facilities in the lead up to Christmas.

It's told the ABC:

We do not expect this to impact our Australian operations.

Its also hitting back at the unions over the strikes.

Shoppers will spend almost $70b in lead up to Christmas: Roy Morgan

Shoppers are expected to spend $69.8 billion during the lead up to Christmas, up 2.7 per cent on last year's figures, updated data from Roy Morgan reveals.

Its survey found consumers are ready to fork out $28 billion on plum pudding and turkey, which is an increase of 4.2 per cent on a year ago, while there's an expected increase of 1.6 per cent in the discretionary (non-food) category.

Consumers will spend $28b on plum pudding and turkey(Supplied: Phillippa Grogan)

It said $5.7 billion will be spent on clothing (up 3.3 per cent), $10.8 billion on other retailing (up 4.7 per cent) — which includes categories such as recreational goods, books, cosmetics — and $10.6 billion on hospitality (up 4.7 per cent).

The gift spend is forecast to be $11.8 billion this year, up $1.6 billion on last year's figures.

In total, 16.7 million Australians will buy Christmas gifts in 2024, up 1 per cent on 2023.

On average, those shoppers are forecast to spend $707 each, up $61 on the average recorded a year ago.

The Australian Retailers Association's Fleur Brown says the Christmas season trading period is critical for retail, with many discretionary retailers making up to two thirds of their annual profit during peak season.

Next year looking 'turbulent' according to global markets forecaster

S&P Market Intelligence has released its latest global economic forecast and called it 'Turbulence ahead', which is not very encouraging.

Its economic outlook has changed significantly this month off the back of shifts in US policy.

Ken Wattret, global economist at S&P, said 2025 would surround policy changes in the US.

"Given the anticipated resurgence of inflationary pressures that are likely to halt the Fed's easing cycle, global financial conditions will be significantly less supportive than we had previously anticipated. This poses challenges for economic growth, leading us to revise our forecasts downward across the board."

Some key highlights include predictions about China:

Real GDP growth for the year in China has been revised to 5.0%, slightly from the previous estimate of 4.9%.

It reflects stabilisation in demand and "stronger-than-expected industrial production growth since September", which was bolstered by China's latest stimulus package "and the front-loading of exports ahead of proposed US tariff increases".

2025 agenda: Insurance fees

Re your comment on what to report in 2025… More investigative reporting on how insurance companies set their premium increases would be great. We received a 95% increase on our premiums this year… Not much has changed about the property. Still on the same land, in the same Melbourne suburb (McKinnon), still no flooding or bushfire risk… Yet somehow double the cost… Is there any scrutiny or is it a free for all?

– Blen

I agree Blen, insurance is a topic that is going to need more and more scrutiny as prices are set to continue rising. We're on it!

What do you want to see us report on in 2025?

It's been a big year for business. Supermarkets, energy companies, and insurance (just to name a few) have all been under fire.

With 2024 quickly drawing to a close, what do you want to see us report on next year?

Are there any industries or issues you believe are going unreported?

Let us know in the comments!

Is the Australian share market in a big correction?

Is there any data that'd suggest how the ASX is likely to track over the next several months? What (and when) are the major events that could materially influence its trajectory?

– Aaron W.

I'll see if we can get this answered soon but for now I'll repost Ian Verrender's good take on the markets woes and if we're in a big correction.

Wish I knew the answer. They say stock market gains are built upon a wall of worry. Every time there is a decent run, investors get the heebie jeebies and start thinking: it may have been overdone.

This time is no different. Well, maybe it is a little different because there certainly seems to be some justification for thinking we’ve gone a step too far.

There is no doubt valuations on Wall Street and on our market are stretched by any historical measure.

Wall Street has been driving this global stocks boom so let’s just concentrate on it.

It has punched through record levels more than 50 times this year and if you compare company earnings to share prices, American stocks are in nosebleed territory with prices at 27 times the most recent earnings.

That’s not the highest it’s ever been but it is certainly elevated and way above the long term average of 19.6 times earnings. So, yep, stocks are expensive.

If you compare current share prices to forward estimates of earnings, the situation is even more extreme. At 22 times earnings, the ratio is close to the stimulus driven mania we witnessed during the pandemic and within reach of the all time high of 25 that occurred around the turn of the century during the dotcom boom. And we all know how that ended.

If there’s a trigger for a massive sell-off next year, it will all get down to what happens with US interest rates. Yesterday we saw big falls globally after the US Federal Reserve indicated it may not cut as much next year as previously anticipated.

If Donald Trump’s tariffs push inflation higher, the Fed’s Jerome Powell may be forced to reverse course on interest rates. That would ignite a massive sell-off.

In the meantime, gains are likely to be driven by the weight of money and two acronyms; TINA (there is no alternative) and FOMO (fear of missing out).

Which may explain why the Commonwealth Bank continues to forge ahead despite the lack of any rational explanation.

AGL slammed for 'abuse of trust' and for potential appeal of $25m welfare fine

I just asked Bill Shorten about the AGL scandal, in which it overcharged people on welfare through the Centrelink payment facility, Centrepay.

The Federal Court found the power company overcharged 483 Centrepay customers from 2016 to 2021, and has slapped it with a $25 million fine.

Centrepay is a service that lets people allocate bills to be paid out of their support payments before they get their cash.

Its had a lot of issues identified, and is now being reformed.

Bill Shorten, who is set to retire from politics in February, is currently the minister responsible for Centrelink.

He got very fired up this morning over the AGL issue.

Here's a bit of my discussion with him:

ET: What did Centrelink know and how long did it take to fix this situation. Did it know about AGL taking this money incorrectly for months, years?

BS: The incident occurred under the Liberals. I don't know what Scott Morrison or the Liberals knew, but since I've come in 2022 we have overhauled the Centrepay system.

ET: Should AGL be banned from Centrepay now?

BS: Pretty good point. I'll raise that with our people, and it is an abuse of trust.

ET: I know you're saying 25 million is a big spanking for the company, but they are saying that they don't expect it to impact their profit margins for this financial year (so) is 25 million really a spanking?

BS: If they think the $25 million is a just a day at the beach … For them, I think that would be the worst example of corporate communications since the people who were, you know, promoting the Titanic. The reality is that if you think the $25 million is just a speeding fine, then you are so out of touch.

ET: And the company has also said that it will look at the judgment and consider whether it should appeal. Would you support it appealing?

BS: Corporations have legal right in this country, not going to say that they don't.

But if I was doing the government relations, reputation management for AGL, I would look in the mirror and say, really? We've been caught out, essentially unlawfully taking money from some of the poorest people in Australia.

They did the wrong thing. They've coped a fine, and as a result, I think the best thing you can do is put a big ad in the newspaper and say, sorry.

The real thing is they should never have done it to begin with, not have some existential navel gazing with lawyers about how much money they're going to spend appealing being caught out.

The ASX is now trading at a 3-month low

It's also down 4.3% (so far) this month. That's the worst monthly drop all year.

It's also the biggest monthly drop since September 2022, which gives context to how bad the recent performance is.

ASX is now down 1.1 per cent

From the ASX website:

Sectors are mixed. 10 of 11 sectors are lower today along with the S&P/ASX 200 Index. Utilities is the best performing sector, gaining +0.71% and rebounding from its recent decline. This sector is off -0.32% for the past five days.

ASX 200 now down 1 per cent

It's getting worse as the morning drags on.

Bill Shorten is slamming AGL over the Centrepay scandal

The minister responsible for Centrelink is speaking right now about the $25 million fine for AGL that was announced yesterday, saying its shareholders should be asking questions.

The power company was slammed with the fine after a scandal in which it overcharged "vulnerable" people on welfare without their knowledge.

Here's some of what he's said so far:

AGL shareholders, I think, should be asking senior AGL leadership, how can you have a debt collection system which is misfiring like that?

This is a legal spanking which means they will not sit down for a long time. The fact of the matter is that they should never have done this.

You can read more on this here:

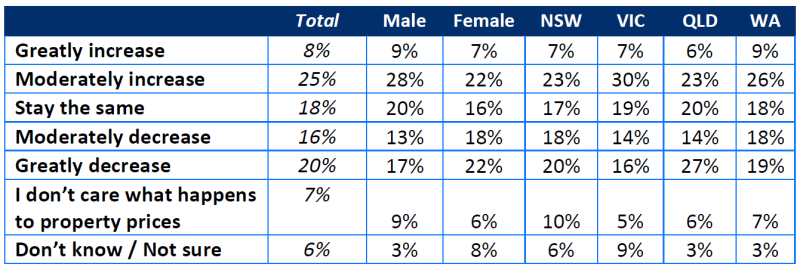

More Australians want property prices to fall than rise, finds survey

Contrary to conventional political wisdom, a new survey conducted for the Australia Institute has found a narrow majority of Australians want property prices to fall.

The survey asked just over a thousand Australians this question: "In coming years, do you want property prices to increase, stay the same or to decline?"

The answer? A third want to see an increase (with most of those wanting just a modest rise), just under one-fifth of people wanted them to remain steady, while 36% wanted a decrease (the majority of whom wanted a big drop).

The remainder didn't know or said they didn't care.

"In coming years, do you want property prices to increase, stay the same or to decline?"(Australia Institute)

Unsurprisingly, those who own or are paying off their own home were more likely to want rising prices, but it was still less than half.

More surprising, perhaps, is that 18% of outright owners and 24% of people with mortgages said they be happy to see prices drop, while more than a fifth of both groups were happy to see property values stagnate.

A staggering, but completely unsurprising, 42% of renters wanted to see prices "greatly decrease".

The only group where a majority of respondents were in favour of rising property prices was amongst property investors, with 59% wanting rising values, and just under a quarter preferring stable values.

Only 12% of investors said they wanted the value of their property investment to fall.

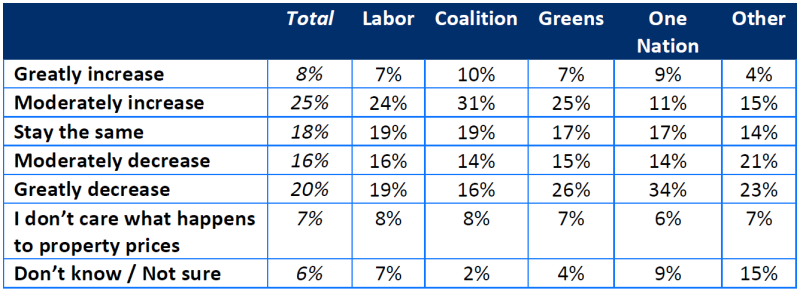

Sentiment was broadly similar by voting intention, although Coalition voters were slightly more likely to want a rise in property prices, while both Greens and One Nation voters were more likely to want a large fall.

"In coming years, do you want property prices to increase, stay the same or to decline?"(Australia Institute)

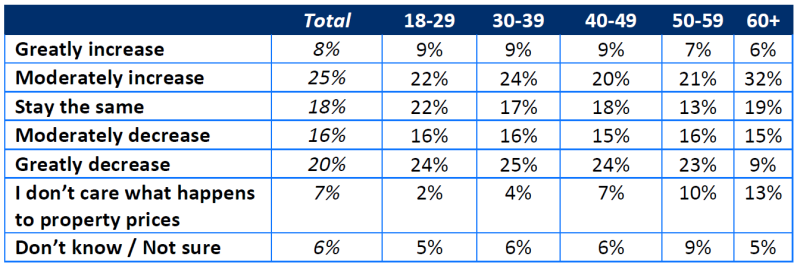

Perhaps the most surprising result was the remarkable consistency across all age groups, except for those over 60.

Close to a quarter of respondents across all younger age groups wanted property prices to "greatly decrease", but only 9% of older Australians selected that response.

Nearly a third of over-60s preferred a moderate increase in prices, the most of any group.

"In coming years, do you want property prices to increase, stay the same or to decline?"(Australia Institute)

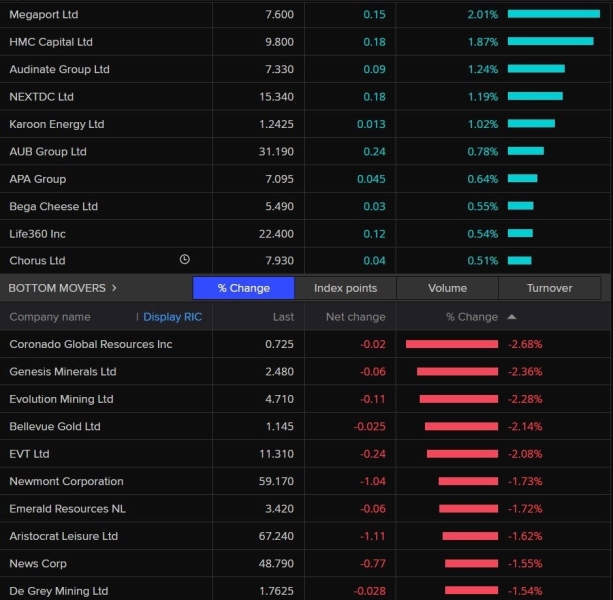

Here's what individual stocks are doing this morning

The biggest losses are on consumer discretionary stocks.

(Refinitiv)

ASX 200 is now almost 0.9 per cent down

It is off 0.85% and setting a new 20-day low.

Most sectors on the ASX trading down

This from the ASX website:

Sectors are mixed. 10 of 11 sectors are lower over the last week along with the S&P/ASX 200 Index. Although little changed, Consumer Staples is today's best performing sector. It is down -0.39% for the past five days.

Thanks to our loyal audience!

Hi Emilia, Thanks for the brilliant work of the business team this year. Cheers,

– Michael

We couldn't do it without you.

Market snapshot

- ASX 200: -1.1% to 8,106 points

- Australian dollar: -0.1% to 62.33 US cents

- S&P 500: -0.1% to 5,867 points

- Nasdaq: -0.1% to 19,373 points

- FTSE: -1.1% to 8,105 points

- EuroStoxx: -1.5% to 507 points

- Spot gold: +0.1% to $US2,595/ounce

- Brent crude: -1% to $US72.67/barrel

- Iron ore: -0.1% to $US104.10/tonne

- Bitcoin: +0.4% to $US97,670

Prices current around 11:25am AEDT

Are global markets at the start of a massive spiral?

Is the share market at the start of a correction?

– Glenn

Thanks for asking what everybody is wondering!

I put this to our chief business corro, Ian Verrender.

Wish I knew the answer. They say stock market gains are built upon a wall of worry. Every time there is a decent run, investors get the heebie jeebies and start thinking: it may have been overdone.

This time is no different. Well, maybe it is a little different because there certainly seems to be some justification for thinking we’ve gone a step too far.

There is no doubt valuations on Wall Street and on our market are stretched by any historical measure.

Wall Street has been driving this global stocks boom so let’s just concentrate on it.

It has punched through record levels more than 50 times this year and if you compare company earnings to share prices, American stocks are in nosebleed territory with prices at 27 times the most recent earnings.

That’s not the highest it’s ever been but it is certainly elevated and way above the long-term average of 19.6 times earnings. So, yep, stocks are expensive.

If you compare current share prices to forward estimates of earnings, the situation is even more extreme. At 22 times earnings, the ratio is close to the stimulus-driven mania we witnessed during the pandemic and within reach of the all-time high of 25 that occurred around the turn of the century during the dotcom boom. And we all know how that ended.

If there’s a trigger for a massive sell-off next year, it will all get down to what happens with US interest rates. Yesterday we saw big falls globally after the US Federal Reserve indicated it may not cut as much next year as previously anticipated.

If Donald Trump’s tariffs push inflation higher, the Fed’s Jerome Powell may be forced to reverse course on interest rates. That would ignite a massive sell-off.

In the meantime, gains are likely to be driven by the weight of money and two acronyms; TINA (there is no alternative) and FOMO (fear of missing out).

Which may explain why the Commonwealth Bank continues to forge ahead despite the lack of any rational explanation.

It's looking like another bad day on the ASX

The All Ords is about 0.7% down while the ASX 200 is down even more so far.

Yesterday jittery investors wiped about $50 billion off the Australian share market's value.