Australia has been hit with more bad news on the economic front as long-term interest rates and inflation continue to rise.

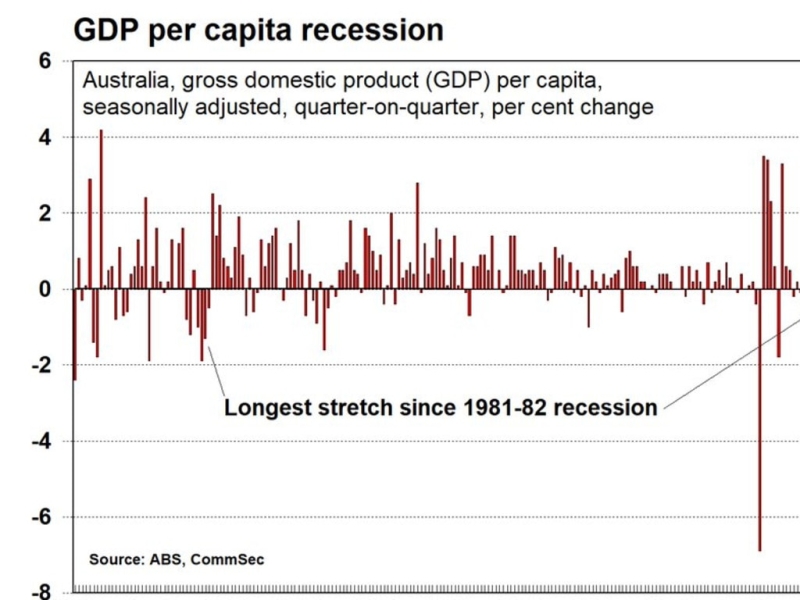

The Treasurer sought to put the blame on wage growth as Australia’s GDP per capita fell for the seventh consecutive quarter.

National accounts data released by the Australian Bureau of Statistics on Wednesday showed that gross domestic product unexpectedly fell in the September quarter, growing by just 0.8.

Shadow treasurer Angus Taylor said: “We saw it in today’s numbers .. labour productivity is in free fall.

Taylor said slowing productivity and economic growth made a rate cut unlikely.

“Ultimately the Reserve Bank is concerned about the balance between supply and demand. With productivity falling, supply is moving in the wrong direction,” he said.

“If they are going to have an easier time getting inflation and interest rates down, they (the RBA) need to see strong productivity growth and we are already seeing core inflation moving up.”

The data showed GDP grew 0.3 per cent, largely due to government infrastructure projects and energy rebates. The economy grew 0.8 per cent in the 12 months to September 2024.

Federal Treasurer Jim Chalmers says government policies are helping Australia escape recession as economic growth figures come in below expectations. Photo: NewsWire/Nikki Short

However, household spending generally decreased, business investment remained sluggish, and the per capita GDP growth rate was negative 0.3.

Finance Minister Jim Chalmers acknowledged that economic growth was below market expectations but argued that government spending had helped the economy escape a hard-landing recession.

“The most encouraging and important aspect of the national accounts today is what they show about real income growth,” Chalmers said.

“The rise in real incomes reflects not only the progress we have made in keeping inflation in check, but also solid wage growth and the very important Government’s cost-of-living tax cuts.”

Employee remuneration rose by 1.4% overall, with the largest increase in the private sector. Increases in wages, bonuses, headcount and new enterprise agreements in the information media, telecommunications, construction and financial services sectors were the main drivers of the increase.

GDP per capita fell 1.5% year-on-year in the third quarter, down from 1.4% in the previous quarter. Image source: CommSec

“If we don’t deliver a responsible and balanced budget, without providing cost of living supports, Australians will be worse off and economic growth will be weaker,” the Treasurer said.

“The Australian economy continues to maintain positive momentum, albeit at a softer pace.”

Australian Bureau of Statistics director of national accounts Katherine Keenan said the economy had grown for the 12th consecutive quarter but had continued to slow since September 2023.

The strong performance this quarter was driven by public sector spending, with government outlays outstripping consumer spending.

Household spending was flat in the September quarter after falling 0.3% in June.

The biggest drag on growth was electricity and gas spending, as rebates were implemented to reduce energy bills. These rebates are counted in the national accounts as a transfer from household spending to government spending.

Federal Finance Minister Jim Chalmers warned of a weak economic outlook. Photo: NewsWire/Nikki Short

“The fall in household electricity spending due to the rebate was offset by increases in other categories,” Ms Keenan said.

“Prices for clothing and footwear rose due to unusually warm weather, and basic spending also rose modestly as rent, health and education services continued to grow.”

Overseas spending by Australian visitors also boosted growth in tourism categories such as hotels, cafes and restaurants, and entertainment and culture.

Independent economist Saul Eslake said before the data was released that the RBA would be keeping a close eye on the household savings rate, which rose to 3.2 this quarter.

“One thing the RBA will be watching closely is whether the household savings rate rises. In other words, whether households are saving or spending the tax cuts,” he said on Tuesday.

“In their view, aggregate demand (spending) by households, businesses and governments continues to outpace aggregate supply.

“They can’t change aggregate supply, but they can bring demand in line with aggregate supply.”

Sean Langcake, head of macroeconomic forecasting at Oxford Economics, agreed.

“We expect GDP growth to pick up slowly in the coming quarters. The fundamentals of improving consumption growth are favorable,” he said.

As government spending as a share of GDP continues to rise, retail spending remains subdued. Photo: NewsWire/Luis Enrique Ascui

“But the improvement is not spectacular and the economy will continue to grow below trend in the short term, while capacity constraints will continue to play a role,” he said.

While the September rate of growth was not strong, it was still up compared to the first half of the year, with growth in the June quarter at just 0.2.

This means that Australia’s economic growth in the year to June 30, 2024 is the weakest it has ever been outside of the coronavirus pandemic.

Excluding the coronavirus pandemic, the annual GDP figure was the weakest since the end of the recession in the early 1990s.

IG market analyst Tony Sycamore said Wednesday’s data showed the impact of the Reserve Bank of Australia’s restrictive policy settings.

“The RBA’s latest forecasts in its November monetary policy statement show economic growth is expected to rise to 1.5 per cent by December 2024 and to 2.3 per cent by June 2025,” he said.

“However, today’s data showed the growth trajectory diverged further from forecasts, casting doubt on the RBA’s hopes for a smooth landing.

Angus Taylor claimed Labor’s “big government” agenda was hurting the economy, while the RBA governor said the economy “would be worse off” without a big boost to the public sector. Photo: NewsWire/Martin Ollman

“With the RBA showing no signs of cutting interest rates just yet, all eyes will be on whether this week’s rise in October retail sales is a one-off event or a sign of a sustained improvement in consumer and business confidence.”

The finance minister managed expectations ahead of the release of national accounts data on Wednesday and said the trend was expected to continue in the short term.

However, Chalmers said Australia was still on track to escape restrictive high inflation and achieve a soft landing.

“Without the contribution of public demand, growth would have been much weaker,” he said.

“Most of this government spending comes from the states, but the largest share at the federal level is defense spending.

“The latest data show that state and local public demand contributed 60% of the increase in public demand.”

RBA Governor Michele Bullock last week backed Australia’s big spending budget, saying “the economy would be worse off without it”.

In a speech to the Committee for Economic Development of Australia’s annual dinner, Ms Bullock said government spending was helping to keep the economy growing.

“Government spending is helping to keep the economy, at least for now, on an even keel,” she said.

“Without it, if that gap isn’t filled, then the situation in the job market is likely to be much worse.”

Ms Bullock backed the government’s push to increase public sector jobs, saying they were what Australia needed.

“I don’t think non-market job growth is a bad thing. It’s a good thing. We need these people,” she said

“They’re teachers, they’re nurses, they’re aged care workers. These are the people we need.”