Has Australia's economy turned the corner? (from left: Shadow treasurer Angus Taylor, Reserve Bank governor Michele Bullock, treasurer Jim Chalmers). (ABC News: Marco Catalano, Nick Haggarty, James Carmody)

Economists say Australia has turned a corner.

They say inflation has declined, real wages are growing, economic activity has picked up, and interest rates have been cut.

They say we've achieved this outcome without a recession or a big rise in unemployment, which is remarkable.

"That has never been accomplished before in Australia," independent economist Saul Eslake says.

But shadow treasurer Angus Taylor is warning voters about "grim trends" in the economy that aren't going away.

Last week, he said labour productivity was still "disastrous" in Australia and the purchasing power of our wages had deteriorated "disastrously" since Labor won the election in 2022.

"This is not an economy which will lead to prosperity," Mr Taylor claimed.

How can both things be true?

The surge in inflation in 2021 and 2022

Let's look at some graphs to understand what's going on.

The first graph shows how inflation was behaving before the federal election in May 2022 and how it has behaved since.

Note how prices started rising increasingly quickly 12 months before that election.

Between May 2021 and May 2022, headline inflation jumped from 3.3 per cent to 6.1 per cent before rising further. The Coalition lost that election, and the economy was handed over to Labor.

That surge in inflation destroyed the purchasing power of our wages.

By the time the 2022 election was held, the "real" value of our wages (which takes inflation into account) had already deteriorated so much that our wages were buying less than they could buy in 2014.

See the next graph below.

In the graph, when the blue line falls below the black horizontal line (when it slips below 100) that's the moment when the real value of our wages became less than it was worth in 2014.

That's the situation Labor inherited when it won the last election.

Labor was aware of that situation too.

Two days before the 2022 election, then-Shadow Treasurer Jim Chalmers had this to say to voters:

"Whoever wins the election on Saturday will inherit high and rising inflation, with interest rates rising as well, the worst real wages cut in more than 20 years, and a trillion dollars in debt with almost nothing to show for it," he said.

The shock of rapid price increases

Now, have a look at the third graph.

This graph helps us to visualise how inflation destroyed the purchasing power of our wages so effectively.

The red line in the graph is the consumer price index. It shows how prices started rising rapidly in late 2021 and how much they have risen since.

Note how that line starts to flatten out in the top right-hand corner of the graph.

That "flattening out" occurred because the pace of inflation slowed down considerably in the second half of last year. That convinced the Reserve Bank of Australia (RBA) that it could cut interest rates last month.

Now, check the blue dashed line, which is a hypothetical scenario.

It takes the average rate of inflation in the period from March 2014 to December 2019 (1.7 per cent) and it grows the series forward to imagine what prices might look like today if there had been no COVID economic shock.

What does it show?

The blue line suggests that, if there were no COVID disruption, prices would have increased by 20 per cent between early 2014 and late 2024 (a period of 11 years).

But as the red line shows, prices increased by 20 per cent between early 2020 and late 2024 (a period of five years).

So, the COVID shock brought a lot of inflation forward by five years.

That illustrates why the price rises we experienced in recent years were such a shock: a 20 per cent increase in prices would seem "reasonable" relative to a decade ago, but it feels extremely "unreasonable" relative to just five years ago.

Declining labour productivity

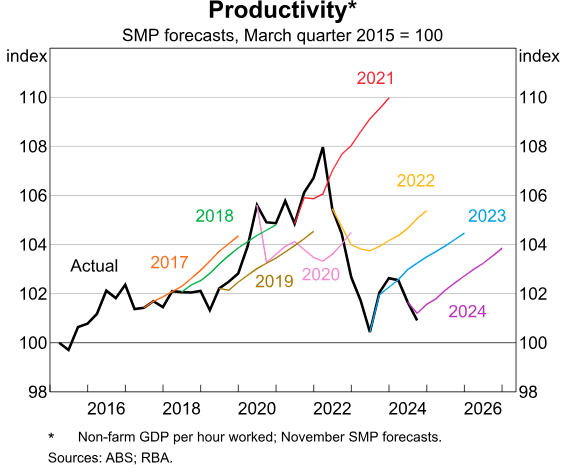

Now, what about "productivity"?

Last week, Mr Taylor warned voters that labour productivity (output per hour worked) was still going backwards in Australia.

"That means there's less money to pay for those goods and services that Australians are used to being able to buy. It's why they're having to work harder to make ends meet," he said.

"It's why the purchasing power of their incomes has gone down so disastrously since Labor came to power."

It was an important point.

Productivity falls back to earth after pandemic sugar hit

Photo shows A sign on brown paper in a cafe window reads: We're hiring staff, looking for hospo all rounders

But, thankfully, the head of the RBA's economic analysis department, Michael Plumb, delivered an informative speech on this topic last month.

His speech was titled Why Productivity Matters.

Mr Plumb said a range of explanations had been provided for the global slowdown in productivity growth that had occurred since the 1990s, including in Australia.

He said the most recent slowdown in productivity growth had also been a global phenomenon, with similar experiences in Australia, New Zealand, Canada, the UK, and the Euro area, with the exception being the United States where growth in productivity was relatively strong in recent years.

However, Mr Plumb said productivity growth in Australia had been consistently below the RBA's projections for many years, and RBA officials were trying to wrap their heads around it.

His speech is worth reading.

(Reserve Bank of Australia, "Why Productivity Matters" (27 February 2025), by Michael Plumb.)

When you inherit a mess, how long does it take to fix?

Now, when we look at those graphs above, it illustrates why we can tell very different stories about Australia's economy right now.

On one hand, Bureau of Statistics data shows Australia's economy has turned a corner.

Inflation has declined significantly (although the challenge is not over), and it's occurred without a recession. Our disposable incomes have been rising, real wages are growing again, and the RBA has felt comfortable enough to cut interest rates a little.

Australia's economy rebounds

Photo shows A woman carrying shopping bags.

But, on the other hand, the real value of our wages has deteriorated so much from the outbreak in inflation in recent years that our weekly wages still cannot buy what they could buy in 2014.

The RBA says that situation will take years to fix (although it looks like things are heading in the right direction).

And until it's fixed, households will feel financial pressure.

The national decline in productivity, which predates the COVID era, also needs a huge amount of attention.

But if Mr Taylor were in power right now, and if he'd gotten inflation down without a recession and without a material increase in unemployment, would he be happy about it?

One suspects he may be (which treasurer wouldn't?).

And he would probably be asking voters for a few more years to finish the job, too.

That's what his Coalition colleagues did when they won the federal election in 2013. They spent many years after that election, through three more election cycles, talking about the mess they had "inherited" from the previous Labor government in 2013 and why it had taken so long to fix things.