Australian shares have dropped sharply at the open of trade, closely following a dire day on Wall Street after US President Donald Trump confirmed he will implement tariffs on several major economies.At the time of publishing the ASX 200 was down 1.10 per cent or 91 points and trending lower as local traders looked to cut their losses.All 11 sectors opened in the red and if the momentum continues the local bourse will wipe all of its gains year-to-date.

Generic scences at the ASX on the day of sharp falls across markets due to coronavirus fears. Monday 9th March 2020 AFR photo LOUIE DOUVIS (Louie Douvis)Overnight US stocks slid as investors braced for President Donald Trump's proposed tariffs on Canada, Mexico and China to go into effect by the deadline on Tuesday (Wednesday AEDT).The Dow tumbled 650 points, or 1.48 per cent, on Monday to close at 43,191. The Dow fell almost 900 points in afternoon trading before pulling back slightly. The broader S&P 500 slumped 1.76 per cent and the Nasdaq Composite dropped 2.64 per cent.The Nasdaq is down about 6.5 per cent since Trump took office on January 20.

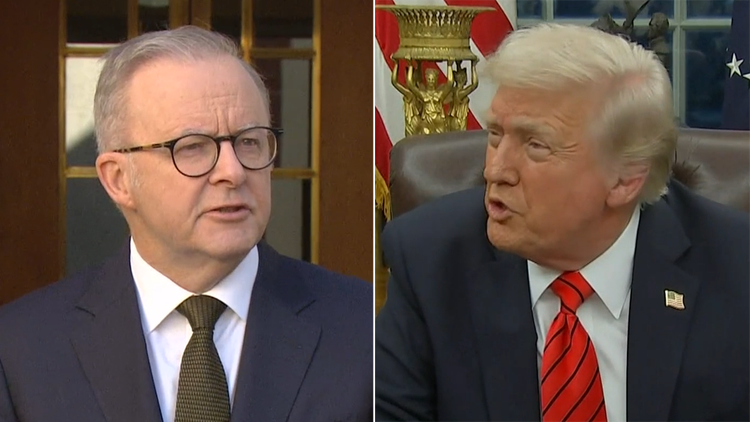

US President Donald Trump at the White House in Washington, on Monday, March 3, 2025, confirmed 25 per cent tariffs would be imposed on Canada and Mexico this week.. (Pool via AP) (AP)"Tomorrow, tariffs — 25 per cent on Canada and 25 per cent on Mexico," Trump said during a press conference at the White House. "And that'll start. … What they have to do is build their car plants, frankly, and other things in the United States, in which case they have no tariffs."Trump said on Monday the two trading partners had "no room" left to negotiate to avoid the levies and that he was using tariffs to "punish" countries that, as he put it, were taking from the US economy without giving enough in return."They're all set. They go into effect tomorrow," he said.The VIX, Wall Street's fear gauge, surged to its highest point this year after Trump's comments."Due to the uncertainty surrounding the tariffs, the stock market has erased the gains from the 'Trump bump' following the presidential election and the expected upward pressure on prices is giving investors pause," said Gustavo Flores-Macias, a professor of government and public policy at Cornell University in the north-eastern US.LIVE UPDATES: Where Cyclone Alfred will cause the most damage

Stocks in chipmaking company Nvidia fell in response to Trump's declaration on tariffs. (AP Photo/Seth Wenig) (AP)Commerce Secretary Howard Lutnick said at the press conference that global companies can avoid tariffs if they invest into production in the US, such as TSMC, the Taiwanese chipmaker at the White House on Monday to announce a $US100 billion US investment.Trump's tariffs will raise prices of imported goods, which could boost demand for goods produced in the US, according to analysts at Goldman Sachs. But they also noted that tariffs will have negative effects on some American businesses."Tariff increases will also raise production costs for some domestic producers and will likely prompt foreign retaliation against some US exports, both of which could hurt domestic production," they wrote in a note.US stocks are "likely to be volatile" until Trump's policies points toward being more growth-focused, said Jason Draho, head of asset allocation for the Americas at UBS Global Wealth Management, in a note on Monday.Draho said he does expect future growth and maintains a "positive medium-term outlook."The stocks dragging markets lower on Monday included Nvidia (NVDA), which fell 8.7 per cent.The yield on the 10-year Treasury bond slid to 4.16 per cent, signalling concerns about uncertainty and future economic growth.Bitcoin traded around $US85,600 on Monday afternoon, down 8.6 per cent in the past day and largely erasing gains made after Trump on Sunday announced a strategic crypto reserve that would include bitcoin.Meanwhile, shares in defence companies in Europe soared to record highs on Monday as European leaders consider the need to re-arm amid less US support for Ukraine.