The ASX fell on Thursday, as several major companies traded without access to their latest dividend payments, while the Australian dollar moved higher overnight.

The future of Star Entertainment remains uncertain as its share continue to be suspended from trade.

Here's how the session unfolded on the ABC News markets blog, plus insights from our specialist business reporters.

Disclaimer: this blog is not intended as investment advice.

Key Events

-

Local share market ends in the red

-

Qantas updates on impact of Cyclone Alfred

-

Reports Star close to deal with Hong Kong investors

Market snapshot

- ASX 200: -0.6% to 8,094 points

- Australian dollar: +0.1% to 63.36 US cents

- S&P 500: +1.1% to 5,842 points

- Nasdaq: +1.5% to 18,552 points

- Spot gold: flat at $US2,919/ounce

- Brent crude: +0.5% to $US69.65/barrel

- Iron ore: +0.3% to $US101.05/tonne

- Bitcoin: +2.4% to $US92,550

Prices current around 4:35pm AEDT

Cya tomorrow

That's all from the business blog for the day.

We'll be back tomorrow bright and early to take you through the overnight news and how the final session of the week is shaping up.

In the meantime, catch The Business with Alicia Barry on ABC News Channel from 8.44pm AEDT, after the late news on ABC TV and anytime on iView.

Chief business correspondent Ian Verrender will be giving the latest of Star Entertainment's attempts to secure a financial lifeline.

And please stay up to date on Cyclone Alfred at the ABC News live blog if you're in the path of the storm.

Stay safe.

Local share market ends in the red

Australian shares fell out of the opening blocks and remained in negative territory throughout the session.

The ASX 200 lost 0.6 per cent, while the All Ords dropped 0.4 per cent.

That's despite a strongly positive session on Wall Street overnight, and mostly gains across Asian markets as well.

The major drag on the Australian market was the energy sector, after days of falling oil prices, while CBA also weighed on the broader index as it traded ex-dividend.

Here's how the individual stocks moved:

Top % gains

- West African Resources (+11/9%)

- Johns Lyng (+7.8%)

- Bellevue Gold (+7.4%)

- Sandfire Resources (4.8%)

- Cochlear (+4.6%)

Worst % falls

- Woodside (-4.7%)

- Smartgroup Corp (-4.1%)

- AGL Energy (-4.1%)

- Resmed (-3.4%)

- Lovisa (-3.1%)

ASX still down ahead of the close

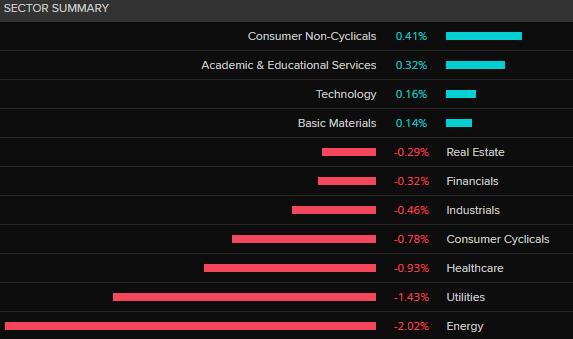

Less than an hour from the close and the ASX 200 is down by half a per cent, with a fairly even split between the number of stocks rising and falling.

The worst performing sector is energy (-5.6%), followed by education (-1.8%) and utilities (-1.7%).

The only sectors making gains are technology (+0.4%), real estate (+0.2%) and materials (+0.1%).

Market snapshot

- ASX 200: -0.6% to 8,095 points (live values below)

- Australian dollar: +0.1% to $US63.38

- S&P 500: +1.1% to 5,842 points

- Nasdaq: +1.5% to 18,552 points

- Spot gold: +0.1% to $US2,920/ounce

- Brent crude: +0.6% to $US69.69/barrel

- Iron ore: +0.4% to $US101.20/tonne

- Bitcoin: +1.2% to $US91,452

Prices current at around 2:50pm AEDT

Qantas updates on impact of Cyclone Alfred

Qantas has provided an update on its flights, as Cyclone Alfred is predicted to cross the Queensland coast early Saturday morning.

Qantas and Jetstar flights in and out of Brisbane will be suspended from mid-afternoon until at least midday Saturday for international operations, and at least Sunday morning for domestic.

Gold Coast and Ballina operations are currently suspended, while Qantas flights to and from Coffs Harbour are expected to resume tomorrow.

Sunshine Coast and Hervey Bay continue to operate.

The airline is advising customers to check its app and websites.

Qantas shares are currently down 2 per cent.

Reports Star close to deal with Hong Kong investors

Star Entertainment will be handed a lifeline by two investors, according to reports in the Australian Financial Review.

The casino operator is "on the brink" of an agreement with two of its Hong Kong investors, Chow Tai Fook Enterprises and Far East Consortium, to buy its Brisbane's Queens Wharf development and secure a $50 million loan, the AFR reports, citing sources with knowledge of the deal.

Star has warned it would be unlikely to be able to sign off its half-year financial accounts, without refinancing its debt and securing extra cash.

Its shares are currently suspended from trade, after it missed the reporting deadline.

Shareholder activist Stephen Mayne told the ABC a deal with the Hong Kong investors would not be a "foregone conclusion" as it could lead to debates over "probity and foreign ownership".

"If Star is out of [Queen's Wharf] entirely, they won't have to stump up the $358 million they were due to spend after opening Brisbane last year."

Star is yet to finish the full build of its casino on a 13-hectare site in Brisbane.

"[Star would] shed the massive liability of completing a gold-plated facility," Mr Mayne said.

On Wednesday, Star insiders told ABC News insolvency group FTI has been briefed to assume control of the company, which is set to run out of cash by the end of the week.

Building approvals rise in January

The total number of dwellings approved rose 6.3 per cent in January, according the Australian Bureau of Statistics (ABS).

It was largely due to approvals for apartments, with approvals for private dwellings excluding houses up 12.7 per cent.

"A number of large apartment buildings approved in New South Wales have driven the upward movement over the past two months," the ABS noted.

House approvals increased 1.1 per cent in the month, after declining for two months.

The value of residential buildings approved rose to an all-time high.

"Lower interest rates and signs of construction-cost pressures easing should see an upward trend in dwelling approvals through 2025," Westpac economists noted.

Australia's biggest coal-fired power station 'driving up energy bills': new report

Australia's largest coal-fired power station is unreliable and driving up electricity prices, according to a new report that argues against the viability of keeping coal plants open beyond their scheduled closure dates.

The report from clean energy consultancy group Nexa Advisory questions the wisdom of a New South Wales government deal to extend the life of the Origin Energy-owned Eraring.

Eraring was slated to close this year, but the state government deal will extend its life until August 2027.

Nexa Advisory's report argues against further taxpayer assistance for Eraring, given the plant's "unreliability" due to frequent outages.

Nexa analysed the performance data of Eraring and found each of its four units had experienced about 6,000 hours, equivalent to two months, of downtime annually over the last four years and that these outages had affected the plant's availability when it was needed most.

Oil steadies after multi-day plunge but traders wary

Oil prices steadied on Thursday after falling over the past four sessions as US tariffs on Canadian crude supply may be eased but investors remain wary of remaining tariffs on Mexico and major producers' plans to increase output.

Brent crude futures were 0.6 per cent higher at $US69.71 by 12:50pm AEDT.

Brent plunged 6.5 per cent in the previous four sessions, dropping to its lowest since December 2021 on Wednesday, while West Texas Intermediate fell 5.8 per centover the same period to its lowest since May 2023.

Prices fell after the US enacted tariffs on Canadian and Mexican trade, including energy imports, at the same time major producers decided to raise output quotas for the first time since 2022.

The decline eased as the US said it will exempt automakers from the 25 per cent tariffs, raising optimism the impact of the trade dispute may be mitigated.

Additionally, a source familiar with the discussions said that US President Donald Trump may eliminate the 10 per cent tariff on Canadian energy imports, such as crude oil and gasoline, that comply with existing trade agreements.

"Trump's trade measures are threatening to reduce global energy demand and disrupt trade flows in the global oil market. This was exacerbated by a rise in U.S. inventory," Daniel Hynes, senior commodity strategist at ANZ said in a note.

Market sentiment remains bearish from the double impact of the tariffs and the decision by OPEC+, the Organization of the Petroleum Exporting Countries and allies including Russia to raise output.

Crude stockpiles in the US., the world's biggest oil consumer, rose more than expected last week amid seasonal refinery maintenance, while gasoline and distillate inventories fell due to a hike in exports, the Energy Information Administration said on Wednesday.

Crude inventories rose by 3.6 million barrels to 433.8 million barrels in the week, the EIA said, far exceeding analysts' expectations in a Reuters poll for a 341,000-barrel rise.

There are further signs of weakness in American oil demand, with US waterborne crude oil imports dropping to a four-year low in February, driven by a fall in Canadian barrels shipped to the East Coast, according to ship tracking data, as refinery maintenance, including a long turnaround at the largest plant in the region, quashed demand.

Tariffs also remain in effect on US imports of Mexican crude, a smaller supply stream than Canadian crude but an important one for US refineries on the Gulf Coast.

Effects of new tariffs on China growth minimal: S&P

Tariff developments continue to drive markets, and are likely to be a key factor in global growth prospects.

S&P Global Ratings describes the economic hit as "negative and asymmetric", with Canada and Mexico to bear the brunt, while China should see minimal impact beyond the rating's agency's previous baseline forecast.

Here's some further commentary from chief economist for Asia-Pacific, Louis Kuijs:

"The additional 10 per cent US tariffs are an obvious negative for China's growth.

"We had incorporated 10 per cent tariffs in our November baseline. The extra levies will mean lower exports and investment, and other spillover effects.

"However, that further drag on growth is offset by two recent developments.

"First, growth at the end of 2024 was better than expected because of policy support, tentative bottoming out of the property sector, and strong exports.

"The stronger momentum helps push up 2025 growth.

"Second, during the National People's Congress annual session, held this week, the government confirmed a relatively ambitious 5 per cent growth target and committed to more fiscal stimulus than we had expected in November.

"In all, we broadly keep our [China] GDP growth forecast unchanged. We project 4.1% growth in 2025 —substantially less than the government's target — and 3.7% in 2026. But we now expect less export growth and stronger domestic demand.

"The additional tariffs will amplify downward pressure on prices.

"Meanwhile, higher-for-longer US policy rates imply a weaker currency.

"Amid unwelcome foreign-exchange market depreciation, we expect the People's Bank of China to cut its policy rate by 20 basis points less in 2025 than we assumed previously."

Jeweller Michael Hill appoints interim boss

Jewellery company Michael Hill has given an update following the unexpected death of its chief executive Daniel Bracken last week.

Andrew Lowe, the current chief financial and supply chain officer, has been appointed as interim CEO, as the board kicks off a global search for a permanent replacement.

The Michael Hill board has also appointed director Claudia Batten as deputy chair to provide support to the leadership team.

"Following Daniel's passing, the board is confident in Andrew's ability to steer the Michael Hill Group through this period of transition," chair Rob Fyfe said in a statement to the ASX.

Last week, the board announced the passing of Mr Bracken "with great sadness", following an adverse reaction to medical treatment for an underlying condition.

"He will be dearly missed," it said on Wednesday.

ASX in the red mid-session

Checking in on how the market is performing a few hours into the session — the ASX 200 is down by half a per cent.

ASX 200 sectors (LSEG Refinitiv)

The local falls come despite a rally on Wall Street overnight, as investors hoped for more exemptions in Donald Trump trade war.

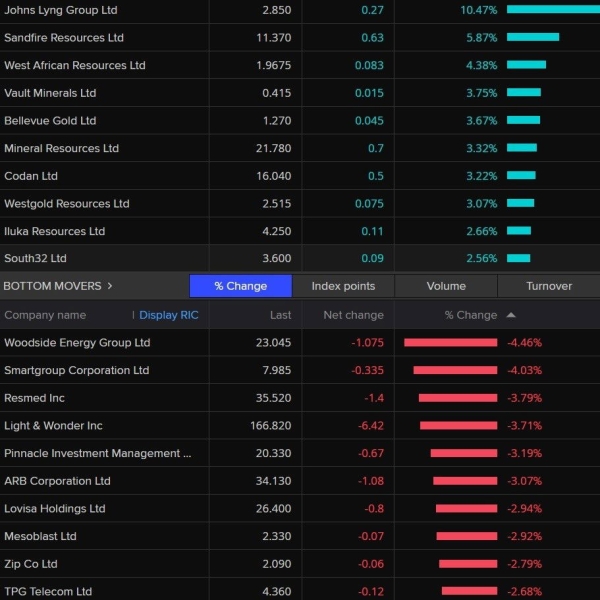

The biggest % falls have been for:

- Mesoblast (-5.4%)

- Woodside (-4.4%)

- Smartgroup Corp (-3.3%)

- Resmed (-3.2%)

- AUB Group (-2.9%)

And the best % gains so far:

- Johns Lyng Group (+8.1%)

- West African Resources (+8%)

- Sandfire Resources (+7%)

- Bellevue Gold (+4.7%)

- Mineral Resources (+4%)

Hi, hello

No Good Morning ? “It's not personal. It's strictly business”

– Aaron

Nice to see you Aaron, hope you're well.

Thanks to Emilia for taking us through the first few hours of market action, I'll be joining you for the rest of the day.

On a serious note, I hope all our Queensland and Northern NSW readers are staying safe — please follow our live blog on Tropical Cyclone Alfred for the latest updates.

Big. Complex. Important: prudential standards to lift

Big news today, that the Australian Prudential Regulation Authority (APRA) has released today eight proposals to strengthen its prudential governance framework for banks, insurers and superannuation trustees.

APRA works largely behind the scenes – it is charged with maintaining the stability of the financial system.

Chair John Lonsdale is currently speaking to journalists about the proposed changes, which are the first significant update to APRA’s governance standards for more than a decade.

The proposed changes include:

- lifting requirements for boards to ensure they have the right mix of skills and experience to deliver the entity’s strategy

- raising minimum standards around the fitness and propriety of responsible persons, and requiring significant financial institutions to engage with APRA on succession planning and potential appointments

- extending existing requirements for superannuation trustees in relation to managing conflicts of interest to banking and insurance

- strengthening board independence, especially in relation to entities that are part of a group

- clarifying APRA’s expectations around the roles of boards, the chair and senior management

- introducing a lifetime tenure limit of 10 years for non-executive directors at an APRA-regulated entity

What does it mean?

This is big.

It's about who gets on boards, how many they can be on, the skills and independence they need.

It will force changes at the top of the tree, putting term limits on board members, essentially stopping people being on a cavalcade of boards and asking leadership to more closely examine who gets to call the shots – and if they're up to it.

Market snapshot

- ASX 200: -0.5% to 8,098 points (live values below)

- Australian dollar: flat at $US63.35

- S&P 500: +1.1% to 5,842 points

- Nasdaq: +1.5% to 18,552 points

- Spot gold: flat at $US2,920/ounce

- Brent crude: flat at $US69.30/barrel

- Iron ore : -0.3% to $US100.50/tonne

- Bitcoin: +0.2% to $US90,566

Prices current at around 11:15am AEDT

Star is still suspended with no news this morning

Its shares have been suspended from trade all week, after it failed to report its latest financials and talk abounds that it is headed for collapse.

The latest here from our economics corrospondent Ian Verrender, who heard from sources that the casino operator is set to run out of cash by this weeked.

Its shares are suspended at 11 cents.

Insurers could be impacted by Cyclone Alfred

Any signs any part of the market is reacting to cyclone Alfred? Are there any stocks in particular affected?

– Andy

Hi Andy, please see my post just a few back about UBS' analysis of which insurers are most exposed to the tropical system.

And of course, if you're in the path of this system, stay safe as the number one priority. Australia is thinking of you!

Thanks for your comments

Mark’s comment is of course blatantly true but that’s how the stock markets work. Governments announce policies and investors react to those announcements. There are winners and losers depending on whether the investor is right or wrong. The only corruption occurs when some investors have “inside knowledge”. Good luck proving it.

– Phillip

This one is a response to Mark's earlier comment that markets are being manipulated by ongoing US trade policy announcements.

The top and bottom stocks on the ASX 200 today

Sectors are mixed. Six of 11 sectors are lower today along with the entire ASX 200 which is off 0.4%. Tech is up the most after the Nasdaq bounced on Wall Street overnight.

Here's the movers and groovers.

(Refinitiv)