The Australian share market lost 1.2 per cent on Friday, after Wall Street fell. The Australian dollar is also down as US President Donald Trump announces more tariffs for China.

Here's how the session unfolded, plus financial news and insights from our specialist business reporters, on our blog.

Disclaimer: this blog is not intended as investment advice.

Key Events

-

ASX, Australian dollar hit

-

ASX falls 1.2pc

-

Conservative news operator buys up 7 Tasmania

Market snapshot

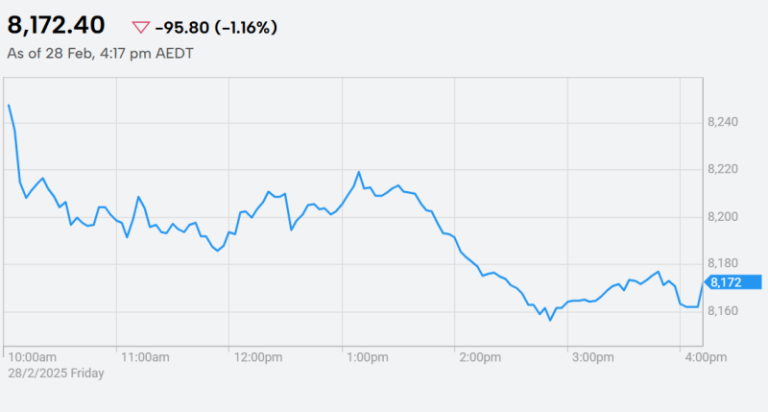

- ASX 200: -1.2% to 8,172 points

- Australian dollar: -0.2% to 62.16 US cents

- Wall Street: Dow Jones (-0.5%), S&P 500 (-1.6%), Nasdaq (-2.8%)

- Europe: DAX (-1.1%), FTSE (+0.3%), Stoxx600 (-0.5%)

- Iron ore: -1.5% to $US103.50/tonne

- Spot gold: -0.7% to $US2,875.20ounce

- Brent crude: -0.5% to $US73.70/barrel

- Bitcoin: -4.4% to $US79,374.42

Prices current at around 4.49pm AEDT

(Live values below)

Have a lovely weekend

That's a wrap for the ABC News business blog this week.

For those of you who've crawled to the finish line, have a relaxing weekend.

The biggest business news today… Star.

If anything changes on that front, this story by ABC News business reporter Kate Ainsworth will be updated:

ASX, Australian dollar hit

It's been a bit of a day for the ASX, hasn't it…

The share market has wiped its year-to-year gains.

Fears about Trump's tariffs on China hurting demand for Australian commodities were a factor.

The Australian dollar fell to its lowest level in close to a month.

Star's big financial troubles continue. The casino operator was supposed to post an update this afternoon, but we're still waiting on that.

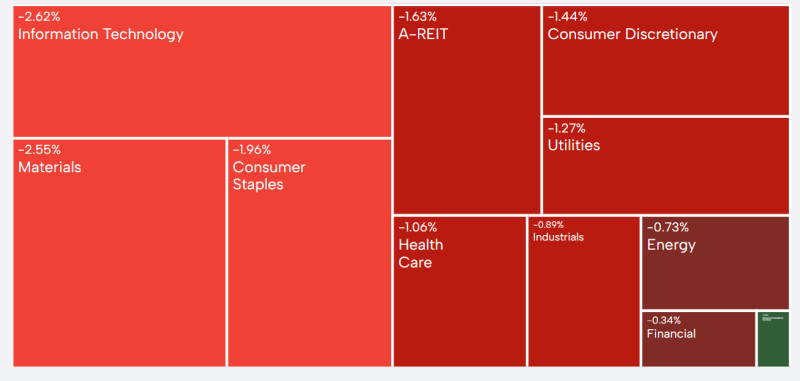

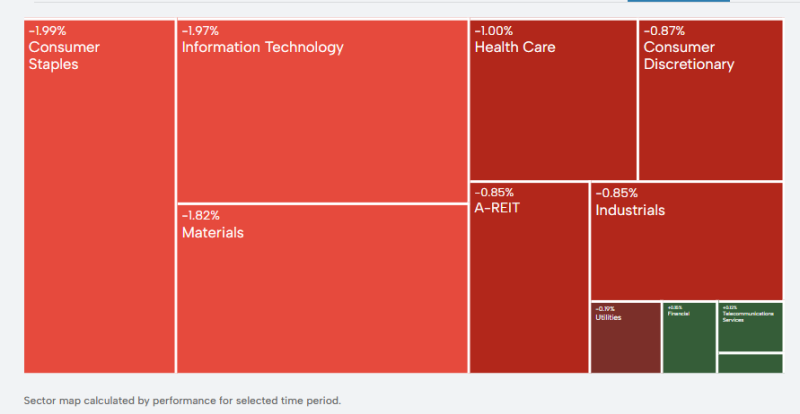

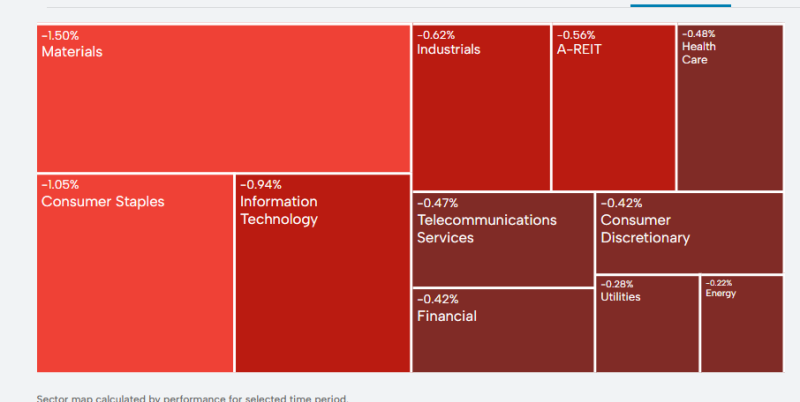

Sector-wise, 10 of the 11 closed in the red. The only sector to rise was telecommunication services.

ASX falls 1.2pc

Okay, the Australian share market has closed and the numbers are in:

The ASX 200 fell almost 1.2% to 8,172, setting a new 20-day low.

Unsurprisingly, Star Entertainment Group was the "biggest loser" today.

More to come.

Conservative news operator buys up 7 Tasmania

An interesting media industry development in Tasmania.

I covered state politics in Tasmania for the ABC, so this announcement is of particular interest to me.

In news this week, conservative news operator Australian Digital Holdings (ADH) has bought up 7 Tasmania, which produces the state's only locally produced commercial news bulletin.

Current owner Southern Cross Austereo announced on Thursday it had sold its television assets in Tasmania, Spencer Gulf, Broken Hill, Mt Isa, Darwin and remote, central and eastern Australia, for $6.35 million.

Will the station's new owners change the flavour of commercial news in Tasmania? We'll see.

Early signs of slower credit growth: Westpac

Westpac's taken a look a private credit:

Private sector credit rose by 0.5%mth in January, in line with our and consensus expectations and below the 0.6%mth pace seen in the prior four months.

All major credit components saw weaker growth. Housing credit increased by 0.4%mth, down from 0.5%mth pace seen previously.

Other personal credit was flat, while business credit rose 0.7%mth, the slowest in four months.Annual growth was unchanged at 6.5%yr, but the three-month growth pace eased slightly from the peak of 1.8% to 1.6%.

"We expect that private credit growth will moderate further as weaker momentum in the housing market will feed into lower housing credit growth, while higher uncertainty might at least to some extent impact business decisions to invest and borrow," says Mantas Vanagas, senior economist at Westpac Group.

However, Vanagas says lower interest rates will be providing some support to credit growth over 2025 and beyond

GDP to show subdued economy: Shane Oliver

All eyes (including the RBA's) will be on the ABS quarterly GDP figures next Wednesday. There'll also be data on house prices, retail sales, building approvals, as well as the RBA's minutes from its meeting that resulted in a rate cut.

Here's what AMP's chief economist and head of investment strategy Shane Oliver reckons the data will show:

In Australia, GDP data (Wednesday) is likely to show that the economy remained subdued in the December quarter at 0.3%qoq or 1%yoy with a lift in consumer spending, dwelling investment and public spending but weak business investment and a detraction from net exports.

While the pick-up in consumer spending will be good news its reliance on discounting suggests it may not be sustained.

CoreLogic data for February (Monday) is expected to show a 0.3% gain in average home prices after a brief dip at the end of the last year with the RBA’s rate cut helping push prices up in Melbourne and Sydney, after several months of modest falls.

In other data, expect a 0.2%mom rise in January retail sales (Monday), a 1% rise in building approvals with the goods trade surplus likely to be around $5.5bn and a 0.8% rise January’s household spending indicator (Friday).

Oliver says the minutes from the RBA’s last meeting (out Tuesday) are likely to reiterate that the RBA was cautious in starting to cut interest rates.

Union concerned for Star Entertainment's 9,000 workers

Chatted to Andrew Jones, the director of casinos and clubs at the United Workers Union, earlier today about the travails of Star Entertainment.

There'll be more on this in the 7pm package, but here's some key quotes:

"The key concern is, obviously that the financial condition at Star is dire, and our concern is that the company drifts into administration.

"Once it enters administration, the administrator will take control and make decisions on behalf of the business. There are two options here, one, where the administrator closes the doors and effectively, our members are out of work, or alternatively, the administrator is able to continue to operate the casino whilst they seek to have someone else purchase it. That's obviously the for better for our members, if the casino is able to stay open.

"Fundamentally, Star workers have been in this place around this direct financial issue since September. However, these issues go back two to three years with their company, and so that level of uncertainty works have been living with for a long time.

" These businesses should be profitable, as we see now, the Gold Coast property is profitable. The other two are not. Currently. Brisbane will get there very, very soon. It's only just opening its new property and the underlying businesses are sound. The company's problems really relate to the overruns cost in Brisbane and the acquiring debt there, and the regulatory issues they've had in the past, which have led the company to the dire financial position they're in.

"Fundamentally, if the company goes into administration, we do expect the state governments to move quickly to work with that administrator can keep the doors open to protect those jobs."

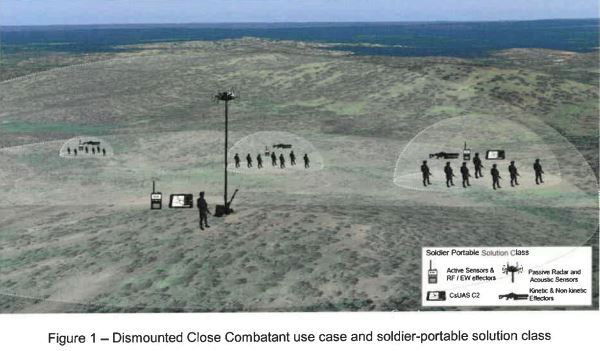

Department of Defence seeks drone-killing machines

Honestly, the things you find on AusTender, the government's key site for buying stuff.

Like a kind of reverse-Gumtree, when the government wants to buy something – like a drone-killing machine – it puts out a procurement notice to businesses who might have what it is looking for.

"LAND 156 – Counter Small Uncrewed Aerial System – LOE2" sounds a bit dry, but the description fleshes it out.

"LAND 156 seeks to procure commercially available, rapidly deployable existing CsUAS technologies suitable for the dismounted close combatant. The system types sought are wearable sensors, portable sensors, kinetic effectors and non-kinetic effectors."

Picture from tender documents of what the Defence Department is seeking (AusTender, Department of Defence)

CsAUS are devices that counter (the 'C') Small Uncrewed Aerial Systems (sUAS).

As the tender notes, drones (sUAS) "pose a significant reconnaissance, surveillance, and targeted attack threat to soldiers".

"To counter this threat, the soldier must be equipped with a reliable and effective force protection system that can detect, identify, track, and neutralise sUAS in all terrain and weather conditions, day or night. The protection system must also minimise the cognitive load on the soldier, allowing them to focus on their primary mission objectives."

If you learn nothing else today – and it is Friday – know this:

- Kinetic effectors "physically disrupt sUAS by launching munitions or projectiles".

- Non-kinetic effectors use "electromagnetic spectrum to jam signals of sUAS, disabling their use".

Lots of big news in the week ahead

The week that's been?

The closers are focused on the week AHEAD.

A cheat-sheet from the CommBank research team lays out what to look for.

- December quarter GDP data the highlight.

- The February RBA Board meeting minutes as well as consumer spending data for January also feature.

- Offshore: European Central Bank meeting, US payrolls and ISM data due.

- The Government Work Report in China is due on Wednesday where government economic targets are set.

|

Here's the take from senior economist Belinda Allen:

|

|---|

Also out, January retail trade, the monthly ABS Monthly Household Spending Indicator (MHSI), and the RBA Minutes for the February Board Meeting.

Deputy governor Andew Hauser (NB: who I call "the fun one") also delivers a key note address on Wednesday.

Always a great speaker – tune in here.

ASIC targets online scammers

ASIC’s latest enforcement and regulatory update is out.

The corporate watchdog says it has taken down 10,000 investment scam websites since 2023.

The most common sites removed include 7,227 fake investment platforms, 1,564 phishing hyperlinks, and 1,257 cryptocurrency investment scams.

ASIC deputy chair Sarah Court said since the agency established its capability in 2023, it was helping shut down an average of 130 investment scam websites each week.

"Scammers are using increasingly sophisticated technology to steal money from hard-working Australians with investment scams that can look shockingly legitimate," she said.

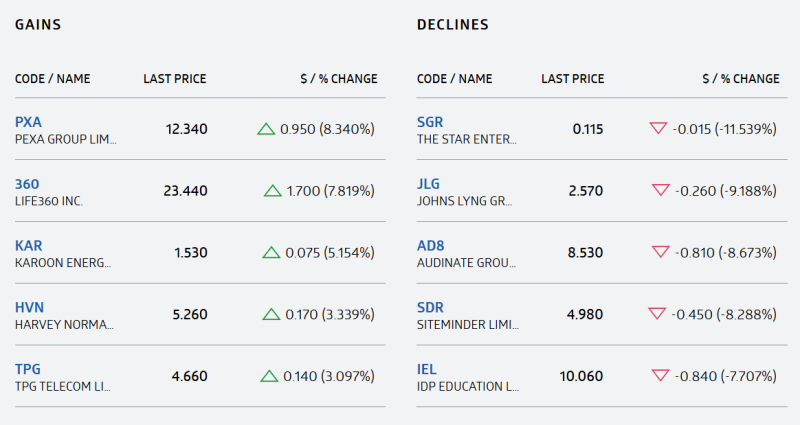

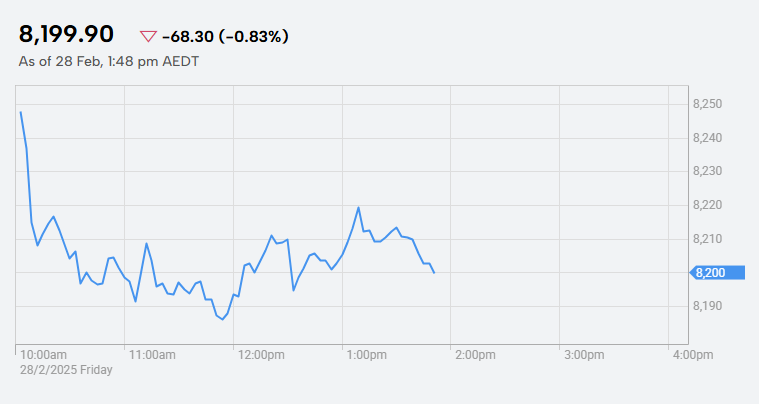

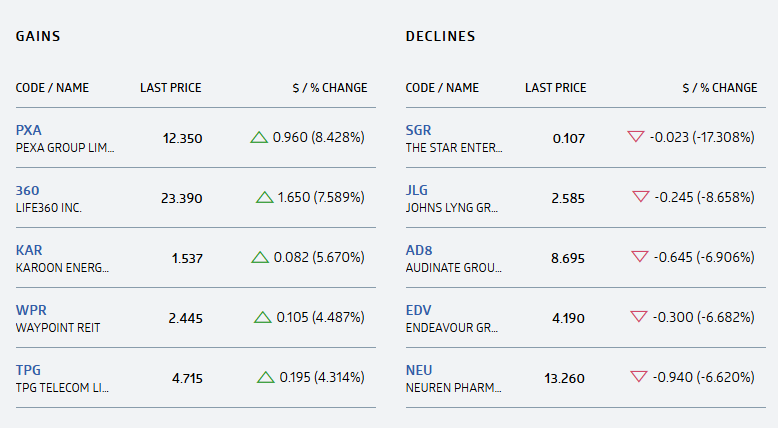

ASX down, Star leads the declines

We're heading into the final two hours of trading.

The ASX200 is down 0.8% to 8,199.

(asx )

Star is leading the declines, followed by John Lyng Group.

(asx gains and declines)

Eight of 11 sectors are in the red.

(asx sectors)

The All Ords is also down about 0.8%.

Qantas results overshadowed by Qatar-Virgin deal

Yesterday was a busy day for aviation.

Qantas announced a 6% rise in half-year profits to $923m.

The federal government also approved Qatar's 25% stake in Virgin.

I filed this report for The Business:

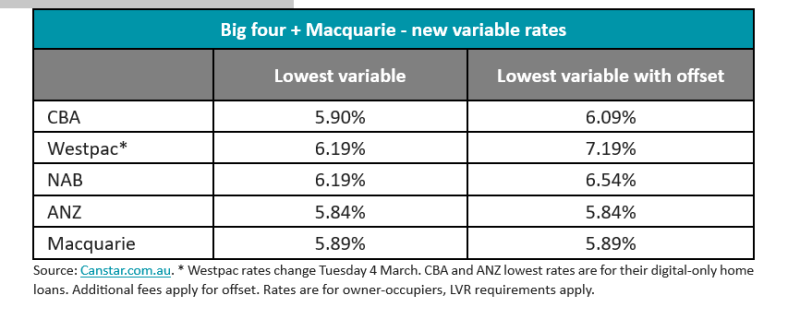

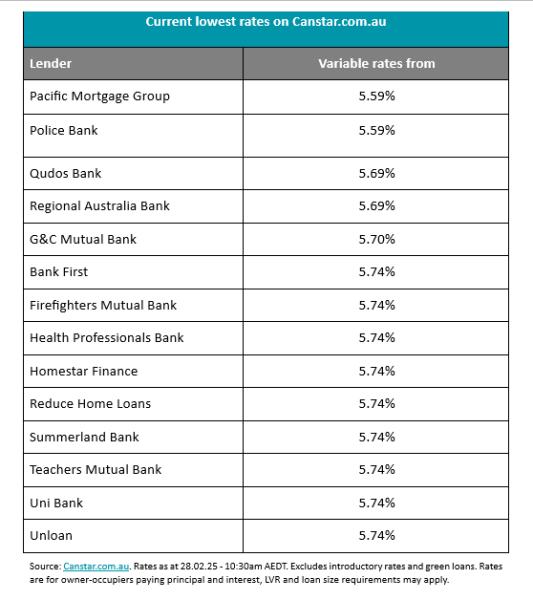

Rate cut kicks in for millions of borrowers

Hanging out for your rate cut after the RBA's 25 basis points cut earlier this month took the cash rate to 4.1%?

CBA, NAB and ANZ variable home loan customers will see their interest rate drop today.

Smaller banks passing on the cut today include Challenger, Macquarie, CBA subsidiary BankWest, ANZ’s Suncorp and the Teachers Mutual group.

Westpac variable home loan customers won't see their rate cut until Tuesday next week.

(Canstar)

According to Canstar, 24 lenders have already dropped variable rates on the back of last Tuesday’s cash rate cut, while about 50 lenders have announced their decision but are yet to pass on the cut to borrowers.

Tracking by Canstar.com.au shows 24 lenders have already dropped variable rates on the back of last Tuesday’s cash rate cut, while just under 50 lenders have announced their decision, with the new rates still to come into effect.

Some banks require customers to adjust their repayments themselves, so worth checking with your own lender.

Here's a look at some of the lowest rates on offer:

(Canstar rates)

As always, it's worth shopping around or hassling your bank for a lower rate.

Star Entertainment at risk of collapse if it doesn't receive bailout today

Star Entertainment could potentially collapse, and the next few hours will be crucial for its survival.

In a statement to the ASX, the struggling casino operator said it's currently exploring "possible liquidity solutions" and that it will receive "one or more liquidity proposals during the course of today".

Star is fast running out of cash, and it's hoping to receive a financial bail-out in the next few hours — one that will "materially increase the Group's liquidity position".

Today was meant to be the day that Star releases its long-awaited half-year results (which are likely to be abysmal), and its directors still haven't signed off on the financial statements.

However, Star said it can online finalise the results after it has "received liquidity proposals, which after appropriate consideration by the Directors, are sufficiently capable of being progressed to finalisation in the context of determining whether the Company can continue as a going concern".

Basically, in the next four hours Star's directors need to:

- 1.receive a good bail-out offer,

- 2.consider whether the deal offers them enough money, without too many stringent conditions,

- 3.at the very least, reach some in-principle agreement to finalise the deal, and

- 4.lodge the half-year results with the ASX.

That's a lot of things to do in a very short amount of time.

If Star fails to publish its results today, the ASX will suspend the company's shares from trading on Monday (March 3).

Its statement ends with this ominous paragraph:

"As noted in the Company's recent ASX announcements, there remains material uncertainty as to the Group's ability to continue as a going concern."

By 12:25pm AEDT, Star's share price had dropped 19.2% to 10.5 cents.

Webjet agrees to pay $9 million fine to settle ACCC case that argued it misled customers

Webjet has agreed to pay a $9 million fine to settle a lawsuit that alleged the airline misled customers with hidden, excessive surcharges.

In November, the Australian Competition and Consumer Commission (ACCC) sued Webjet's subsidiary (Webjet Marketing), arguing that the company breached consumer laws.

In particular, it claimed the travel booking website promoted "cheap flights" between 2018 and 2023 — without adequately disclosing additional fees consumers would incur.

A couple of weeks ago, I spoke to the ACCC chair Gina Cass-Gottlieb, who said:

"Late last year, we took action against Webjet … [for] failure to properly disclose, we allege, the full price, because of the way they represented the minimum price, which actually did not include, we allege, fees that they always charged so that it was not a proper disclosure."

In order to settle the case, Webjet has also agreed to pay $100,000 to cover the regulator's legal costs.

The $9 million penalty will be recognised as an expense in Webjet's full-year results.

The next step is for both parties to file joint submissions to the Federal Court — in order for the settlement to be approved.

If you want to know more about the background of this case, you can read about it here:

Star Entertainment shares plummet 20pc after lifting trading halt

It turned out to be a very brief trading halt for casino operator Star Entertainment.

Its shares are trading again, and investors are furiously hitting the "sell" button.

By 11:45am AEDT, its share price had plunged by almost 20 per cent.

It's the worst performing stock on the ASX 200 by far!

Star Entertainment shares have tumbled to near record lows. (Refin itiv)

No bailout, infers Qld premier

Queensland Premier David Crisafulli says the Queensland government's main focus is protecting thousands of jobs as casino group Star Entertainment faces financial turmoil.

The company — which operates casinos in Brisbane, the Gold Coast and Sydney — was placed under a trading halt this morning after failing to post its half-year financial results.

David Crisafulli says his only concern is job security for the casino's employees.

"Debts that are owed must be paid and we are happy to talk about into the future, about opportunities for whoever might run that business, about opportunities to grow and thrive in Queensland, but our non-negotiable is around the people who work there."

Billionaire hotelier says Star can be saved

Bruce Mathieson, who operates the poker machine and pub empire Australian Liquor and Hospitality with Woolworths, has reportedly attempted to buy Star Entertainment twice.

Speaking on ABC Radio Brisbane with Steve Austin, he says a change of management could save it, despite the dire financial situation.

The casino giant, which runs venues in Brisbane, the Gold Coast and Sydney, has been on the brink of collapse since last year.

Mr Mathieson said poor management had been the company's main issue.

Here are some of the key grabs:

"I wouldn't like it to go into liquidation as far as for the people's [workers] sake. I'm pretty sure there's plenty of deals around that can be done to stop it from doing that. I don't think they know how to handle it myself personally.

"A company that five years ago was worth 6 billion [dollars], now it’s worth virtually nothing

"I’ve had facts and figures just unbelievably wrong given to me … [during negotiations] it’s just a debacle"

He spoke briefly about directors of the Star and about the quality of directors on Australian boards in general.

It's not clear if he's specifically talking about Star's directors in this context — 11 former directors have been taken to court by the corporate regulator, two have settled and been fined and banned from running companies for a period.

"99% of them, people on the board know nothing about the business – and it’s not their money!"

"The Star has been terribly badly run"

In answer to the question, "What should happen now?", the hotel baron said he was against liquidation.

"They should never ever have got into this position.

"To me it’s been a disaster dealing with the management of Star and there’s no doubt the board should be blamed for how bad it is …

"There’s a great chance to save it … you’ll have to cut … you’ll have to do things you don’t want to do to do it. But I’ve got no doubt that with a good team in there in a couple of years you’d have a good business, that’s why I’ve always been trying to buy it."

But will he? Unlikely. He says he's losing interest and is getting a bit old, with some health issues.

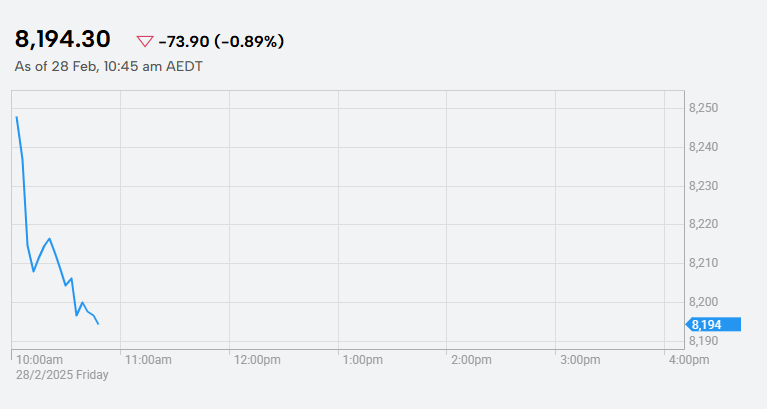

ASX down 0.9%

The ASX is trading lower today, down 0.9% to 8,194 (at approx. 10.50am AEDT).

(asx)

Here's a look at the biggest gains and declines in early trade:

(asx gains and declines)

All 11 sectors are lower, so far today:

(asx sectors)

Star is in a trading halt after failing to post half-year financial results.