The Aussie share market has dodged a technical correction as iron ore and gold miners rise on higher commodity prices.

Stocks in the United States took a tumble off the back of President Donald Trump's threat to impose tariffs of 200 per cent on alcohol from the European Union.

Look back on the day's financial news and insights from our specialist business reporters.

Disclaimer: this blog is not intended as investment advice.

Key Events

-

ASX ends higher

-

Liontown Resources rises on narrower interim loss

-

CAR Group tumbles on ex-dividend trade

Market snapshot

- ASX 200: +0.5% to 7,790 points

- Australian dollar: +0.1% to 62.91 US cents

- S&P 500: -1.4% to 5,521 points

- Nasdaq: -2% to 17,303 points

- FTSE: Flat at 8,543 points

- EuroStoxx: -0.2% to 540 points

- Spot gold: -0.1% to $US2,984/ounce

- Brent crude: +0.7% to $US70.33/barrel

- Iron ore: +1.5% to $US102.20 a tonne

- Bitcoin: +2% to $US81,972

Figures at approx 4:30pm AEDT

Live updates on the major ASX indices:

ASX ends higher

The Australian share market has ended the day in positive territory.

The ASX 200 closed up 40 points or 0.5% to 7,789 on Friday, and ended the week 2% lower.

The mining sector led the gains, rising 4.3% on higher commodity prices.

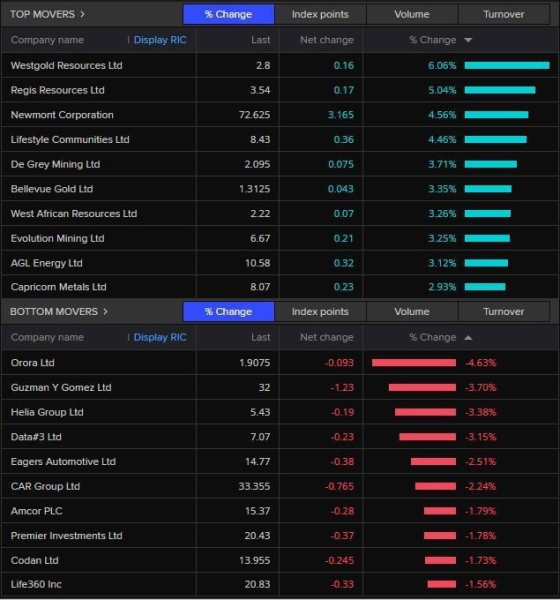

Here are the top and bottom movers of the day.

(Reuters)

Liontown Resources rises on narrower interim loss

Shares of Liontown Resources have risen as much as 7.3% to $0.65, their highest levels since March 7.

The company is on track to post its strongest trading session since February 27.

Liontown stock was among top gainers in the ASX 200 benchmark index.

The battery minerals producer posts a narrower HY net loss after tax of $15.06 million, compared with $31 million a year ago.

Stock is up 24.8% this year, including the session's move.

CAR Group tumbles on ex-dividend trade

Shares of CAR Group have dropped 2.7% to $33.20, their lowest levels since August 9, 2024.

The stock is a top loser on the benchmark index as it trades ex-dividend.

The auto-listings firm announced an interim dividend of 38.5 Australian cents apiece last month.

CAR group shares are down 7.8% year to date, including the day's move.

Asia shares steady, US dollar recovers some losses

Asia shares rose on Friday and global markets attempted a rebound after a brutal sell-off, while gold reached a record as an escalation of global trade tensions left investors nervous and sparked a flight to safe-haven assets.

Relief over the likely aversion of a US government shutdown boosted stocks in early Asian trade after Senate Democrat Chuck Schumer said he would vote to advance a Republican stopgap funding bill, signalling that his party would provide the necessary support.

US stock futures rose sharply in response, with the Nasdaq up 0.87% and S&P 500 futures advancing 0.7%.

Elsewhere, Japan's Nikkei reversed early losses to rise 0.12%.

Hong Kong's Hang Seng Index similarly gained 1%, but was headed for a 2.3% weekly decline. China's CSI300 blue-chip index advanced 1.4% and was set to rise 0.6% for the week.

The US dollar regained some lost ground on Friday thanks to safe haven flows, but was not too far off recent lows as worries of an impending US recession kept pressure on the greenback.

Safe-haven rush propels bullion to record highs

Seven out of the top 10 performers in the ASX 200 benchmark index are gold miners.

All Ordinaries gold index, comprising of 27 gold miners, rises 3.9% to trade at a record-high.

Gains in line with a rapid surge in gold prices as investors rush into the safe-haven assets amid tariff uncertainties.

Both spot gold and US gold futures are within touching distance of $US3,000 an ounce.

Genesis Minerals up 6.8%, trading at highest level since January 28, 2011.

Shares of Newmont Corp up 5% at a three-week high.

Westgold Resources and Bellevue Gold gain 6.3% and 5.3% respectively, trading at multi-week highs.

The gold index is up 25% this year, including the day's moves, significantly outstripping the heavyweight ASX 200 Financials index, which is down 6.8%.

Top and bottom movers in afternoon trade

(Reuters)

Flood insurance triples in parts of outback Queensland

Six councils in south-west Queensland have banded together to protest an eye-watering increase in insurance premiums of up to 300 per cent.

The South West Regional Organisation of Councils, backed by local federal member David Littleproud, has taken their concerns to the Insurance Council of Australia.

The ICA and Mr Littleproud are discussing potential solutions.

Federal government to give ANZ $2b loan to keep Pacific branches open

The federal government will provide ANZ up to $2 billion as a decade-long loan guarantee to keep its branches open in the Pacific region.

The move comes as countries like the US, Australia and China boost efforts to increase financial influence in the Pacific.

As part of the arrangement, foreshadowed by the treasurer in late 2024, ANZ will invest a further $50 million in its Pacific banking systems to enhance its digital banking offering and support ongoing operations in the region.

ANZ's chief executive officer Shayne Elliott said the arrangement highlighted the shared commitment to continuing to provide access to safe and trusted banking services in the Pacific Island region.

“While the guarantee is not material for ANZ at a Group level, the arrangement will support a more resilient and sustainable ANZ Pacific business, for the future of the region,” he said in a statement.

The funding is expected to take effect in the second half of 2025.

Australian miners rebound as iron ore recovers

The mining sub-index has risen nearly 2%, its highest level since March 7.

Iron ore prices rebounded on Thursday, driven by a wave of short-covering as near-term demand in top consumer China stayed resilient.

Sub-index leader BHP is up 1.8% to $38.93, Rio Tinto gains 1.5% to $117.73 while smaller rival Fortescue rises 2.2% to $16.19.

The sub-index has lost 0.2%, year to date.

Resources minister puts White House on notice

Australia is standing up to Trump's imposition of tariffs on steel and aluminium with a threat of its own.

Resources Minister Madeleine King told the ABC Australia's critical minerals and rare earths "are in high demand".

"We would very much like to have a partnership with the US, but if they don't want to do that, then that's up to them and we'll continue to work with other nations as well."

Political reporter Jacob Greber has all you need to catch up on the development:

Are you going up against Trump?

A lot of you have been getting in touch to cheer on the small business in NSW that is imposing its own tariffs on US products.

Are you a business owner thinking of doing something similar?

Or do you know of businesses retaliating in their own ways?

If so, we'd love to hear from you! You can get in touch with me at [email protected]

ASX opens higher despite Wall St slump

The Aussie sharemarket has opened +0.1% higher on Friday despite a sell-off on Wall Street over escalating tariff announcements.

Financials has opened in the red -0.7% lower, Energy is down -0.3% and Tech slid -0.2%.

Basic Materials, which includes mining companies like BHP and Rio Tinto, is up +1.6%, followed by Utilities +1.1%.

Bottom movers at the open include fast food chain Guzman Y Gomez, which is down -3.7%, and Orora Ltd which dropped almost -5%.

Top movers include Westgold (+5.7%), Regis (+5%), and Lifestyle Communities (+4.6%).

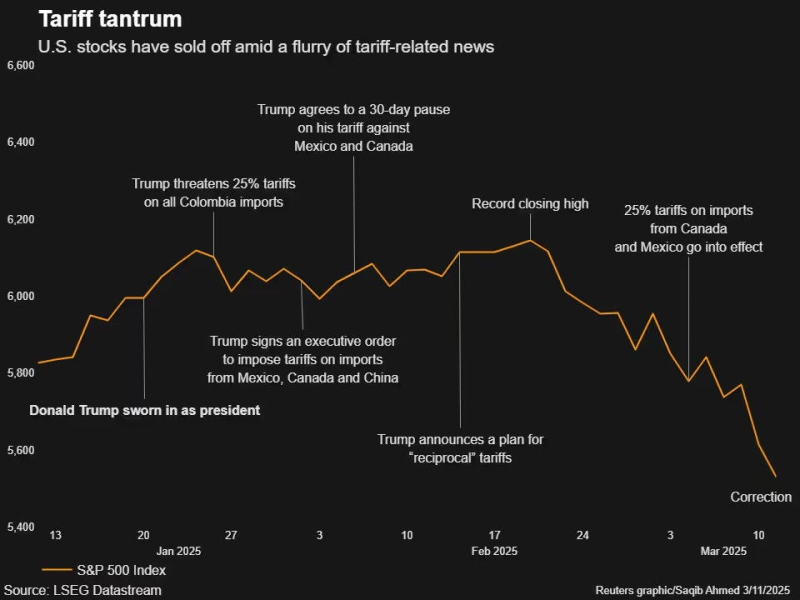

Market reaction to tariffs in one great chart

Reuters has created the below graph to demonstrate how the S&P 500 has reacted to the ongoing announcements from Trump on tariffs:

Calls for calm over escalating tariffs

The American spirits industry has called for calm as tensions and tariff threats escalate between the US and European Union.

Donald Trump has threatened to impose a 200% tariff on wine, champagne, and other alcoholic beverages from the EU in response to the bloc's decision to reinstate a 50% levy on American whiskey.

The Distilled Spirits Council of the United States said in a statement the tariffs "pose significant threats to businesses and employees on both sides of the Atlantic and will harm farmers, waitstaff, bartenders, truck drivers and retail workers while also depriving consumers of products they know and enjoy".

"We are encouraged by reports that EU Commissioner for Trade and Economic Security Maroš Šefčovič and U.S. Secretary of Commerce Howard Lutnick will discuss the proposed escalation of tariffs on U.S. and EU spirits and wine tomorrow. This dialogue is a positive step towards resolving trade tensions and finding mutually beneficial solutions.

"We urge the U.S. and EU to refrain from imposing these tariffs and to engage in negotiations to resolve the underlying trade issues on steel and aluminum."

Aussie cafe goes up against 'schoolyard bully'

Lol that place in NSW that put tariffs on US products…I forget where. B something…

– Natty

Right you are Natty!

A cafe in rural NSW has imposed its own "tariffs" on American-made and owned products.

The ABC's Central West team has everything you need to know:

Dan Ziffer's finance report

My colleague Dan Ziffer has everything you need to know about how the market fared yesterday:

Meta's 'Community Notes' to roll out in US next week

Facebook owner Meta has announced it will start testing 'Community Notes' in the United States from March 18, using technology developed by X.

Meta founder Mark Zuckerberg said two months ago his company would stop its independent fact-checking service to align himself with President Trump and Elon Musk.

Community Notes, which is also used on X, relies on crowdsourcing to flag potentially misleading content on Instagram, Facebook and Threads.

US dollar hammered by Trump's trade policies

The US dollar has fallen about 3.8% against a basket of other currencies so far this month.

The fall comes as the Euro rises on defence spending and hopes of an end to the Ukraine-Russia war.

The US dollar has also been hit by weak sentiment associated with the tit-for-tat US trade war, that threatens the US growth outlook.

NAB's Senior FX Currency Analyst Rodrigo Catril spoke to presenter Alicia Barry on The Business last night about the potential cost to American households and the risk of inflation from Trump's tariffs.

S&P 500 falls from its February high

This 3-month graph shows the record close the index reached on February 19 (about three-quarters across the chart) when it hit 6,144 points.

Since then it's been steadily falling and closed at 5,521 points on Thursday in the US.