Some Australian banks have lowered fixed rates on home loans ahead of the Reserve Bank's meeting on Monday.

The ASX 200 seesaws as reporting season ramps up, while Commonwealth Bank's half-year profit beats estimates.

Disclaimer: this blog is not intended as investment advice.

Key Events

-

Trump's tariffs could make a rate cut next week more likely

-

Rex to be government-owned if airline fails to find buyer

-

Aussie dollar flirts with monthly high

Market snapshot

- ASX 200: +0.1% to 8,491 points

- Australian dollar: -0.1% to 62.90 US cents

- S&P 500: Flat at 6,068 points

- Nasdaq: -0.4% to 19,643 points

- FTSE: +0.1% to 8,777 points

- EuroStoxx: +0.5% to 549 points

- Spot gold: -0.1% to $US2,895/ounce

- Brent crude: Flat $US77.00/barrel

- Iron ore: -1.7% to $US105.00/tonne

- Bitcoin: -0.3% to $US96,105

Price current around 12:07pm AEDT

Live updates on the major ASX indices:

That's all for today

Thanks for reading the business blog today – don't forget to catch 'The Business' at 8.45pm AEDT on the NewsChannel, and even earlier on iView.

We'll be back from early Thursday morning bringing you more news.

House prices tipped to fall in Sydney, Melbourne, Canberra: ANZ

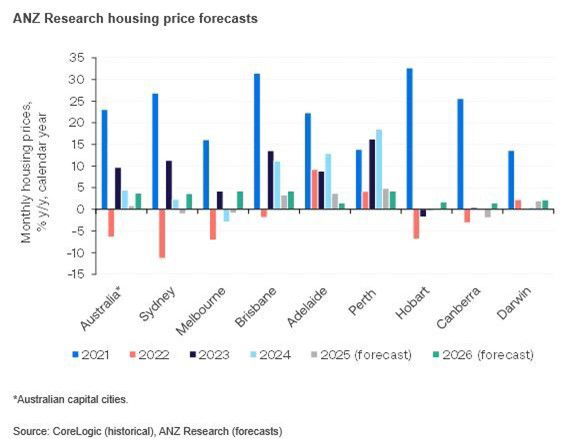

ANZ economists Madeline Dunk and Adelaide Timbrell have reported on their predictions for the housing market.

If you're looking to buy, you'll enjoy their tip – with prices in three of Australia's east coast capitals set to fall.

Predictions of property price rises/falls in Australian capital cities (CoreLogic, ANZ Research)

Here are their key takes:

- Australia’s property market is slowing

- The economists expect this to continue in the "near term, before a modest recovery in the second half of the year"

- They expect capital city housing prices grow just +0.9% in 2025 and decline -1.1% in Sydney and -0.9% in Melbourne

- The year later, 2026, they expect capital city housing prices to rise +3.8% in 2026

- Capital city housing prices have fallen for four months in a row, with Melbourne prices dropping for ten consecutive months

- While housing prices continue to rise in Adelaide, Perth and Brisbane, the pace of these gains has dropped

- Market indicators like expectations, auction clearance rates and time on the market point to ongoing softness.

If interest rates are cut next week, don't expect a price boom, they say.

"As is common in housing cycle downturns, more expensive properties have led the decline. It can take time before rate cuts lead to a lift in prices. We expect that to be the case this cycle, particularly given we only expect two 25bp rate cuts from the RBA. We find that, on average, capital city housing price downturns tend to last about ten months. We expect prices to fall for nine months in a row this cycle".

Market closes +0.5% higher

The flagship ASX 200 index has ended +0.5% to 8,527.1 points.

Investor dip as the money talks

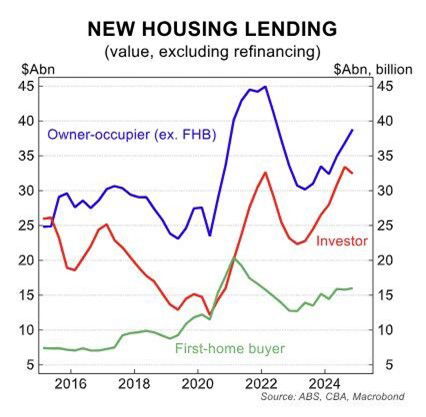

We've had the lending data out (+1.4% in 2024's final quarter)

The value of new home loans in Australia rose in the December quarter as a owner-occupier borrowing pushed out a fall in investment lending.

According to figures from the Australian Bureau of Statistics (ABS) total new home loans rose +1.4% in the fourth quarter from the previous quarter, when they jumped +5.3%.

Loans to owner-occupiers rose +4.2%, while lending to investors fell +2.9%.

New home lending data shows a dip in investors spending up on housing (ABS, CBA, Macrobond)

CommBank's economics team has laid out its analysis of the data.

"New housing lending rose by +1.4%/qtr in Q4 2024, close to our estimate of +1.5%and well down from +5.3% in Q324.

"In annual terms, growth in the flow of new lending for housing eased to +16.0%. The slowdown in lending growth comes in line with a slowing housing market. Lending to investors has driven most of the recent growth but fell in the quarter, down -2.9% taking the annual rate of growth down to +22.2%.

"Lending to owner-occupiers excluding first home buyers was +3.5% higher to be +16.3% higher through the year. First home buyer lending rose +1.5%/qtr (+5.5%/yr).

"The strength in investor lending has been divergent by state, but was broadly softer in the quarter. WA saw the biggest quarterly fall, down =9.3% but this is coming off a period of exceptional growth (+~75% since Q1 23). Vic has been a laggard in part due to higher taxes and a soft property market."

Big profits but small interest

My 'Netbank Saver' account earned a measly $29 last month on a balance of $16,000! Almost "nothing" when compared to billions forked out to Commbank shareholders.

– Mary Chernov

From my calculations Mary, that's an interest rate of about 0.18% per month or 3.8% annually.

I'm not a financial advisor so I can't tell you whether that's good or not, but I can summarise that you'd like there to be less profit delivered to shareholders via dividends and more to depositors via higher interest rates!

Finance workers' union wants more AI protection

Workers in the financial services sector are particularly exposed to the use of – and impact – of artificial intelligence (AI).

The union representing them, the Finance Sector Union (FSU), has welcomed the recommendations in the report from the House Standing Committee’s Inquiry into the Digital Transformation of Workplaces noted earlier in the blog…

Finance Sector Union national assistant secretary, Nicole McPherson said workers should benefit from the potential efficiency gains of AI, rather than it being used by businesses to increase their profits.

“Many of the recommendations of today’s report reflect what finance sector workers are calling for.

“This includes stronger protections for workers against workplace surveillance – which our members tell us is pervasive in their workplaces.

“We support the recommendations for new worker consultation measures, rights for workers to control their own data, controlling the use of AI in high-risk settings, and greater transparency on employer liability around the use of AI.”

An FSU survey of 2,200 finance sector workers found workers feel "unprepared" for the looming wave of AI technology in their workplaces.

Over half of those surveyed said their workplaces had adopted AI technologies. But almost two thirds had not received any training and fewer than one in 10 felt they had a good understanding of AI, the union said.

If you're interested in the complex world of AI, particularly as it pertains to workplace surveillance, here's something I wrote last year about the field.

Should $XB profits mean banks can do better on scams

CBA half year profit of $5.1 billion should really shake up the federal government about banks reimbursing scam losses. Multiplying the half year profit x2 gives an annual profit of $10.2 billion . Estimated scam losses for 2024 in Australia were some $3 billion . Therefore CBA alone could cover every scam loss and still make $7 billion profit. Never mind all the other banks.

– Phillip

There's been great conjecture in the past year about whether banks should reimburse scam victims, and if so to what extent.

The argument from the banks is that indemnifying customers from any consequence would see them liable for losses even when those customers had done the wrong thing – like transferring money overseas to people they don't know, or sharing their passwords with others – and fallen for obvious, well-flagged scams. Additionally, they say jurisdictions like the UK that have done it have created a 'honey pot' attraction for scammers, because consumers take less care.

The alternative view, from consumer groups, is that banks have made transacting vast sums almost frictionless at the same time that increasingly sophisticated scams have infiltrated trusted communications between customers and what they believe are institutions.

One source of agreement is that social media companies have done nowhere near enough to stop the proliferation of scams via their platforms, whereas telcos and others have tightened up massively in preventing the spread.

AI impact on work queried by parliamentary committee

Hi team,

Jumping in as a pinch-hitter to bring the Wednesday blog home.

A 'Future of Work inquiry into the Digital Transformation of Workplaces' has been released by the House of Representative's standing committee on employment, education and training.

I'm just getting through the report, but the recommendations give you a flavour of the issues it chews through.

The Committee recommends…

- 1.that the Australian Government classify AI systems used for employment related purposes as high-risk, including recruitment, referral, hiring, remuneration, promotion, training, apprenticeship, transfer or termination

- 2.that the Australian Government review the Fair Work Act 2009 (Cth) to ensure decision making using AI and ADM is covered under the Act, and employers remain liable for these decisions

- 3.that the Australian Government work with states and territories to ensure greater consistency and modernisation of relevant legislation to enhance employee protections regarding the use of emerging technologies in the workplace

- 4.that the Fair Work Commission review the National Employment Standards to respond to the adverse effects of significant job redesign caused by emerging technologies by enhancing worker entitlements like flexible work arrangements

- 5.that the Australian Government review modern awards for high-risk industries to ensure workers are protected where AI has significantly transformed job design

- 6.that the Australian Government consider developing information campaigns about the use of AI and ADM in workplaces to build public trust of these technologies

There's 21 recommendations in all, available in the report at this link.

Trump's tariffs could make a rate cut next week more likely

Analysts from Rabobank say the RBA stating it was "gaining some confidence that inflation is moving sustainably towards target" at its December meeting raised the likelihood of a February cut.

Before the comments were published Rabobank was banking on the first cut to the cash rate happening in May.

"This was the first time in this interest rate cycle that the RBA explicitly signalled that they were feeling more comfortable with the inflation trajectory," Rabobank senior macro strategist Benjamin Picton said in a note.

He said the RBA's December statement highlighted the board did not expect inflation to sustainably return to the midpoint of the target band until 2026.

"It seems to us that the RBA is suggesting that although demand growth had been weaker than expected, this was not enough on its own to invalidate the November forecasts."

Picton also said Rabobank believed a cut would be announced next week because signs pointed to ongoing disinflation.

"Expenditure categories like rents, new home purchase costs and insurance costs have been major contributors to Australia's recent run of high inflation, but these categories are now displaying quarterly inflation that is more consistent with CPI being back inside the target range.

"In the case of new home purchase costs, prices actually fell in Q4. This suggests that excess demand has now been exhausted and that home builders no longer have sufficient pricing power to pass on higher costs to buyers."

The onslaught of tariff announcements is also making an impact.

The additional 10% tariff on imports from China by the US and a 25% tariffs on steel and aluminium "present the risk of a negative demand shock to the Australian economy".

"A tariff-induced growth slowdown in China could lead to slower demand growth in Australia via decreased appetite for our commodity exports."

WA bauxite company allowed to extend mine

South32 has been granted environmental approval from the Federal Government to extend mining at its Worsley Alumina facility in WA.

South32 owns 86% of Worsley Alumina, which began operations about 41 years ago and is one of the world's biggest alumina refineries.

South32 said it will move forward with developing new bauxite mining areas, which are projected to support production through at least fiscal year 2036.

South32 had initiated the environmental approval process with the Western Australian Environmental Protection Authority (WA EPA) in 2019, aiming to get the green light to mine more bauxite in the native forest south of Perth.

The environmental regulator approved the proposal last July, but it came with a range of conditions due to the sensitive nature of the forest area where mining will take place.

The miner then carried a value assessment of its project and recognised an impairment charge of $554 million on its Worsley Alumina mine, related to conditions prescribed by the WA EPA.

The miner produced 5.1 million tons of alumina last financial year, according to its annual report, and the commodity contributed to around 19% of the group's annual earnings before interest, taxes, depreciation, amortisation.

#ICYMI

If you missed it this morning, the government has announced it will help first-home buyers with HECS-HELP debt get into the market by directing financial regulators to relax how they treat the debt.

Banks will be allowed to discount HECS if they believe it's low risk.

It is the third HELP-related policy Labor has offered up in the last year as it searches for cost-of-living supports with minimal impact on the underlying budget balance.

Will this help you get in the market? Get in touch with us by emailing me at [email protected]

For more check out this story by our political team:

Investor lending falls

The value of new home loans in Australia rose in the December quarter as a rush of owner-occupier borrowing overwhelmed a dip in investment lending, new data shows.

According to figures from the Australian Bureau of Statistics total new home loans rose +1.4% in the fourth quarter from the previous quarter, when they jumped +5.3%.

Loans to owner-occupiers rose +4.2%, while lending to investors fell +2.9%.

Total lending of $87.2 billion was +16% higher than the same quarter a year earlier.

The data is a new quarterly series from the Bureau, which replaces monthly data on loans.

Banks cut fixed rates ahead of RBA meeting

Some banks are already adjusting their fixed rates ahead of the RBA's next meeting on Monday, according to Compare the Market economic director David Koch.

Westpac and its affiliates St George, Bank of Melbourne and Bank of South Australia reduced their one-year fixed rate offers today by 0.40% and two-year fixed rate by 0.30%.

Westpac's one-year principal and interest fixed rate of 5.79% could represent a $165 saving on monthly repayments compared to their previous one-year offer of 6.19% on an average loan of $642,000.

Mr Koch said lower fixed rates could foreshadow a rate cut on Monday.

“Cheaper fixed rates could be enticing for some borrowers who want some certainty in the years ahead. However, if the cash rate does come down as expected, you could find yourself locked into a bad deal,” Mr Koch said.

"While it may be best to hedge your bets on a variable rate, fixed rate moves might provide some hope that rates will start to come down in the new year."

Airports association weighs in on Rex

The Australian Airports Association (AAA) has released a statement on the news the federal government will buy Regional Express (Rex) if no private buyer is found.

"The potential for Commonwealth acquisition should not be taken lightly, and further details are needed on how the airline would operate under government ownership.

"For more than six months, regional residents have faced uncertainty about losing access to major cities — affecting their ability to visit family, access healthcare, and pursue business opportunities," AAA chief executive Simon Westaway said in the statement.

Mr Westaway said many of the AAA's members had taken on "significant debts to support Rex's operations in regional areas".

Japan joins Australia's call for steel, aluminium exemption

Japan's industry minister Yoji Muto has asked the United States to exempt Japan from its steel and aluminium tariffs.

Earlier this week, US President Donald Trump announced he would raise tariffs on steel and aluminium imports to a flat 25% "without exceptions or exemptions".

Mr Trump said the duties would help struggling industries in the US.

Prime Minister Anthony Albanese said the President gave him "a very clear signal" that he was considering giving Australia an exemption during a 40-minute phone call with Mr Trump overnight.

Mr Trump also said he would give "great consideration" to Australia's request due to Australia having a trade deficit with the US.

The US also has a multi-billion-dollar trade deficit with Japan.

Update

Good afternoon, this is Rachel Clayton here to take you through most of this afternoon's trade.

We're halfway through trading and the Aussie sharemarket is looking much the same as it did in early trade.

The ASX200 is flat at 8,486-points.

Computershare Ltd is still leading the top movers up +13.4% to $40.77 after reporting a +28 per cent jump in management earnings to $171.2 million in the first half of fiscal 2025, and hiked its dividend.

It's followed by Zip Co (+2.9%) and AGL (2.8%).

Six of the 11 sectors are in the red.

Education is leading down -1.7 per cent while Utilities is up +1.2%.

Rex to be government-owned if airline fails to find buyer

The federal government says it is prepared to acquire Regional Express or Rex if a suitable buyer for the collapsed airline is unable to be found.

The airline entered voluntary administration last year after it failed to expand into capital city services.

Administrators have until the end of June to find a buyer, while the government has provided funding to ensure its regional flights remain operational.

CBA says Victoria accounts for nearly half its non-performing loans

While not having the exact numbers at hand, CBA's senior management believes that 48% of not performing and not well secured loans are in Victoria, reflective of the weaker economic conditions and falling property market in that state.

"I think a number of businesses that have been reported that the economic conditions and sentiment do seem a bit weaker in Victoria relative to the other states," CBA CEO Matt Comyn observes.

CBA shares rebound

Shares of CBA have reversed early losses, following its better than expected half-year earnings results.

They were 0.3% higher to $162.59, by 11:20am AEDT.

Let's unpack CBA's results by clicking the link below.

This report is from Business Reporter Stephanie Chalmers and Business Editor Michael Janda.